Cancer mortality patterns in insured lives

properties.trackTitle

properties.trackSubtitle

July 2024

Munich Re Life US regularly analyzes death claims stemming from its significant block of fully underwritten life insurance policies to better understand the drivers of mortality related to various causes of death. This paper examines insured lives cancer mortality experience and considers the potential underwriting impact of recent developments in the field of cancer research. It focuses on cancer mortality risk, not the incidence of cancer.

Dataset

Key findings

Cancer is the most common cause of death (Table 1) in Munich Re’s reinsured blocks of life insurance. Specifically, cancer is the most common cause of death across decennial attained age groups except at the youngest (20-29) and oldest (80+) ages.

Focusing on larger face amount, early duration claims, for policies with face amounts of at least one million dollars and in the first three policy years, cancer is the most common cause of death for ages 50 to 89. Accidental deaths are most common for ages 20 to 49.

Early durations

The proportion of cancer claims occurring in durations one to five increased with face amount band, $100,000-$249,999, $250,000-$499,999, $500,000-$999,999, and over

$1 million (Figure 2). This trend persisted even after excluding ages 70 and higher implying that anti-selection may be a partial driver of early duration claims at higher face amounts.

Across all face amounts, the plurality of cancer claims (35%) occurred in policy years six to ten, while less than a fifth (17%) occurred in the first five policy years. For circulatory claims, the highest proportion (35%) occurred in durations 11 to 15, and 14% occurred in the first five policy years. The same trend of increasing early duration claims with face amount was also seen for circulatory claims.

Accidental and suicide claims, with 31% and 23%, respectively, in policy years one to five, tended to occur earlier compared to cancer and circulatory claims.

Figure 3 demonstrates that cancer mortality was lower in the first five policy years compared to years six and above. This pattern was consistent across various face amount and age at death groups.

The above finding for cancer is in contrast to that for non-medical causes of death such as accidents, where early duration mortality exceeds mortality in later durations (Figure 3) for multiple face amount and age at death combinations.

Cancer subtypes and face amount

Cancer subtypes with the highest claims were lung (14.5%), pancreas (8.1%), genital organs (8.0%), colon (8.0%), eye/brain/central nervous system (7.1%), breast (7.1%), and leukemia (6.7%) for the Munich Re block. It is important to differentiate these mortality rates by cancer subtype from the incidence rates of different types of cancer in the US general population. The eye/brain/central nervous system (E, B, CNS) cancer subtype from the list above is the only category that does not appear in the top seven cancer subtype expected deaths for the U.S. general population in 2024.2

On the other hand, the liver and intrahepatic bile duct cancer category is the only one of the top seven cancer subtypes for the 2024 U.S. general population that does not appear in the Munich Re list above. A possible explanation is that liver cancer is often associated with chronic hepatitis and alcohol abuse, which are less common among insured pools and also can often be weeded out during medical underwriting using liver function tests.

Cancer mortality for face amounts above $1 million was better than face amounts of $100,000-$999,999, likely reflecting the positive impact of underwriting and socio-economic factors. However, there are exceptions to this finding for cancer subtypes, as seen in Figure 4 for issue ages 50 to 59 non-tobacco, durations one to five, for pancreatic and (E, B, CNS) cancers for males, and genital and (E, B, CNS) cancers for females.

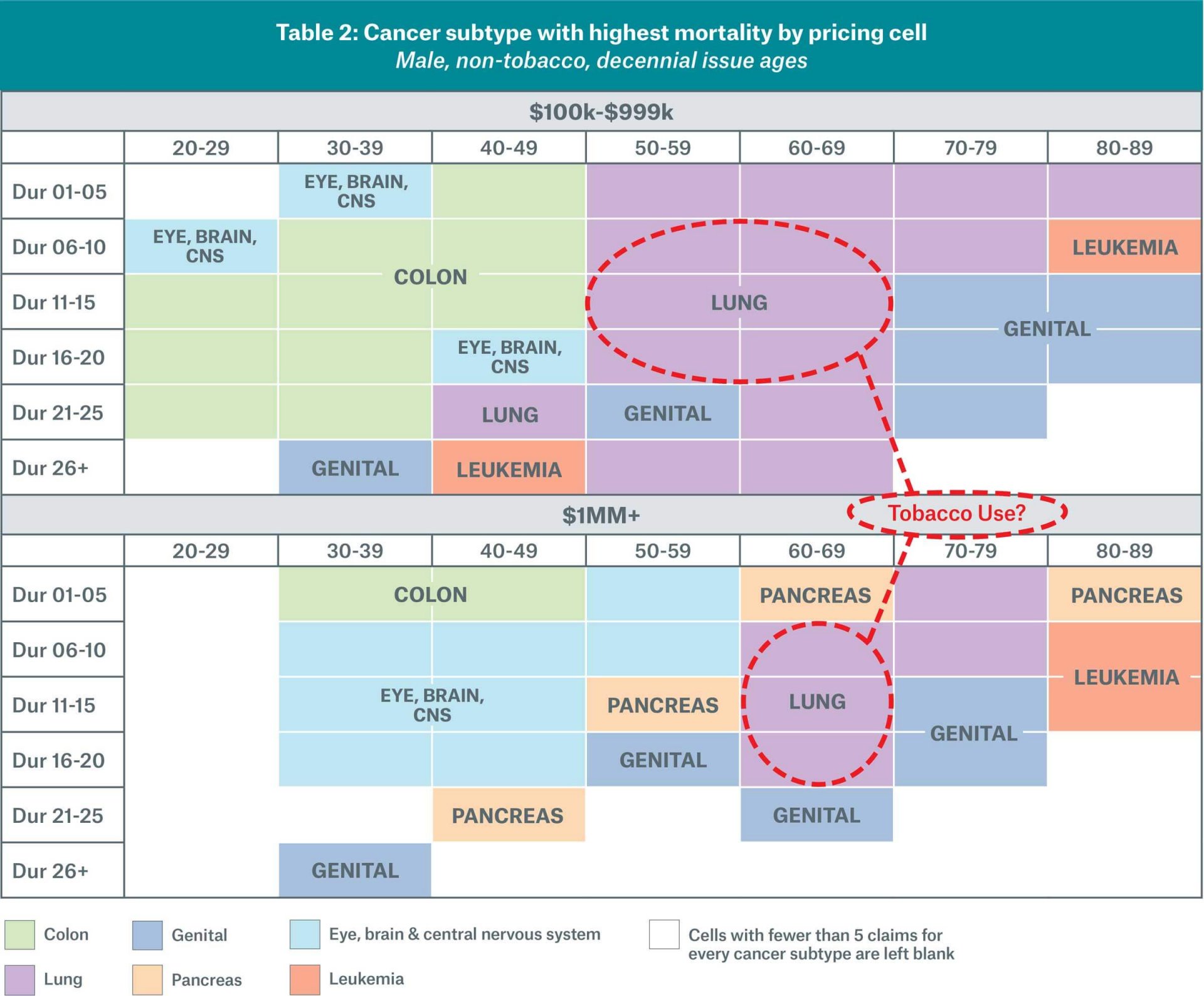

Among male non-tobacco users, for face amounts $100,000-$999,999, lung and colon cancer had the highest subtype mortality (Table 2) in several issue age/duration cells. The occurrence of lung cancer claims points to possible smoking history misrepresentation or a consequence of prevalent industry smoker definitions. For instance, a typical industry criterion to qualify for best preferred in a four class non-tobacco program is that the applicant has not used tobacco products for the last five years.

For the same group, pancreatic and (E, B, CNS) cancers showed some evidence of elevated mortality for face amounts above $1 million, particularly at ages below 60 (Table 2). This may be indicative of a lack of effective screening mechanisms and no effective cures for these subtypes.

Excess mortality risk for smokers

Implications for underwriters and the way forward

Cancer in the population

Industry benefits from recent developments in cancer research

Smoking status

Our research demonstrates that smoking or tobacco use worsens mortality risk for all cancer subtypes. Furthermore, we have seen evidence of increased applicant misrepresentation of tobacco use as non-fluid underwriting options are more widely used in the industry.5 Verifying tobacco use is critical for accurate risk classification. The introduction of an accurate smoker prediction tool would be vital to combating anti-selection in the absence of a fluid-based nicotine screen.

Smoker definitions in a multi-class preferred non-tobacco structure should be assessed for appropriateness. The adverse mortality impact of smoking may linger years after quitting smoking (Tables 2, 3).

Value of other underwriting tools

In an accelerated underwriting environment, without the benefit of fluid testing like urine nicotine screen or blood, a well-constructed tele-app with drill-down questions to tease out smoking history and personal cancer history is a valuable underwriting tool.

Underwriters need to effectively use prescription drug databases, which are a valuable source of medication history, dosage, and physician specialty to classify risk. Electronic health record (EHR) usage is increasingly gaining acceptance in underwriting and proving to be a valuable source of medical history, including cancer. Pathology reports from third-party data providers can be a source of cancer-relevant underwriting information. In addition, polygenetic risk scores can potentially stratify an individual’s cancer risk beyond just age, smoking status, and family history but are unlikely to be adopted in underwriting for a variety of reasons, including reservations associated with genetic testing.

Foreign nationals

Conclusions

With the trend towards non-fluid, data-driven programs, post-issue underwriting can be a cost-effective way for insurers to study the effectiveness of accelerated underwriting. Pilot studies could be performed on samples to compare the effectiveness of new versus traditional underwriting risk evaluation tools in screening for cancer risk. Business analytics should continuously monitor mortality trends in the accelerated underwriting space for differences with traditional underwriting.

Insurers should closely track their cancer claims experience by subtype, face amount band, and duration to protect against the possibility of anti-selection, especially at higher face amounts.

The promise of recent advances in cancer detection research, including MCED tests and advances in precision cancer treatment such as immunotherapies and tumor genome targeted therapies, together with other advances under the Cancer Moonshot initiative, hold untapped promise for the industry and at the societal level.6

Cancer is an age-related disease, and the aging population all but guarantees that we will see more applications from individuals who are adult cancer survivors and those who are at increasing risk for cancer because of aging itself. Healthcare-advised cancer screenings will become increasingly important not just in the mature population but also at younger ages.

With regard to adult cancers, advances in immunotherapy continue to show progress, e.g. in advanced melanoma, non-small cell lung cancers, etc., that will likely expand to other tumor types. These advances bring optimism that people may live longer (quality of life preserved) and for cancer to be treated as a chronic disease rather than a terminal one.

References

3. Siegel RL, Wagle NS, Cercek A, Smith RA, Jemal A. Colorectal cancer statistics, 2023. CA Cancer J Clin. 2023;73(3):233‐254. doi:10.3322/caac.21772, Burus, Todd, et al. "Undiagnosed Cancer Cases in the US During the First 10 Months of the COVID-19 Pandemic." JAMA oncology (2024). 4. Two years on, making impressive strides with GRAIL partnership, Munich Re Life US, 2024. 5. Mortality slippage study and monitoring best practices, Munich Re Life US, 2024. 6. Cancer Moonshot, National Cancer Institute, Medical Innovations Update: Cancer Enhancements in the Digital Age, Munich Re Life US, 2023.