Wearable technology refers to smart electronic devices with sensors that collect and deliver information about their surroundings. Currently, most devices are worn on the wrist, although the technology is available in other forms such as jewelry, glasses, clothing, shoes and implanted devices. The main category of wearables in the market are fitness trackers and smartwatches which gather metrics associated with physical activity: step count, activity minutes, distance, floors climbed and calories burned. More sophisticated models can capture heart rate and sleep patterns.

Wearables introduce a multitude of ways to monitor health. The quality and quantity of information supplied by wearables will transform how we manage our lives. There is a huge opportunity for life insurance companies to change the way we interact with our customers and to improve how we manage risk.

Evidence-based risk determination

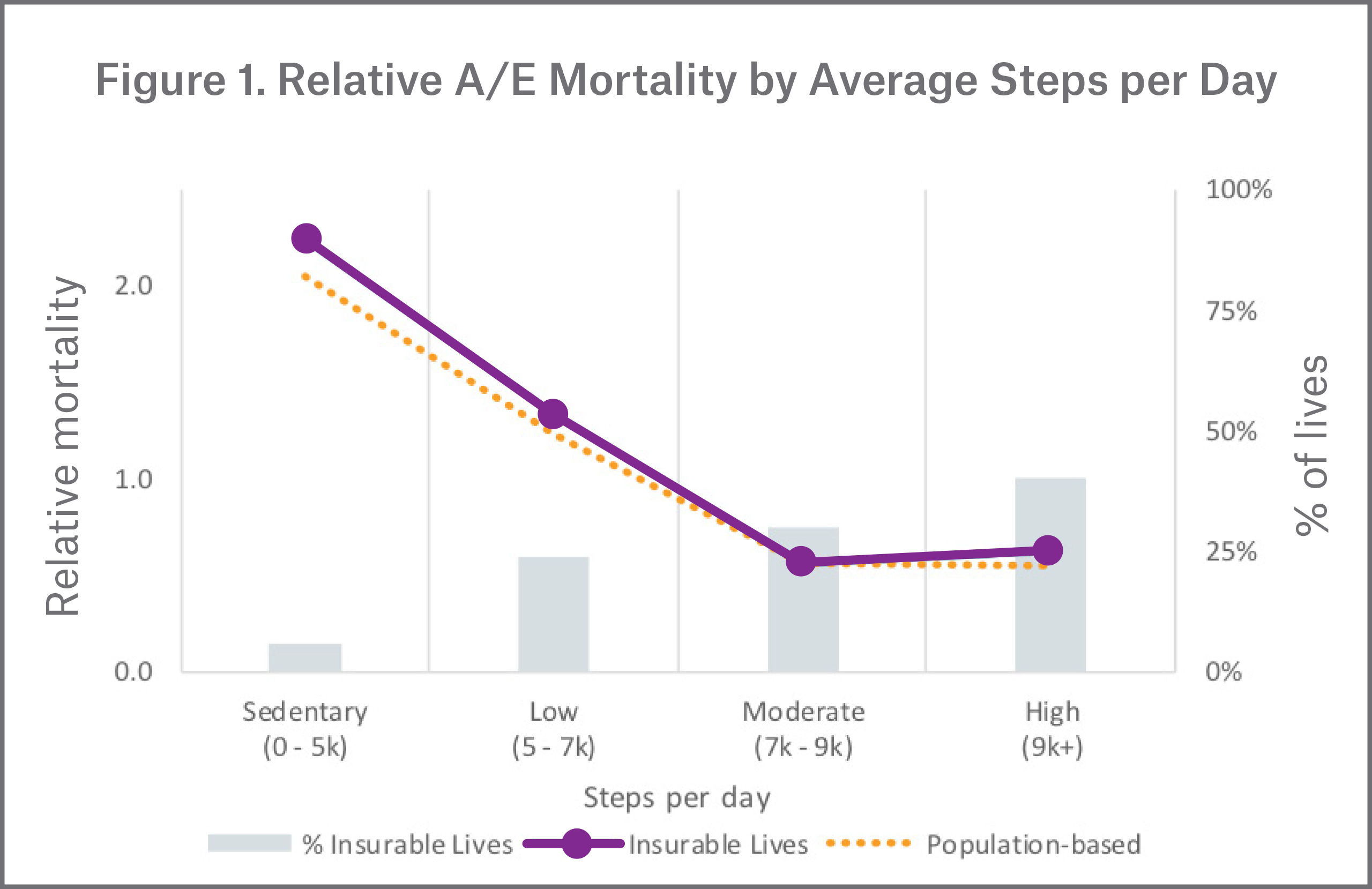

Insurance companies have traditionally relied on protective value studies and medical research to quantify mortality risk. Munich Re evaluated the effectiveness of physical activity as measured by wearable sensors in stratifying the mortality risk profile of a U.S. population-based dataset from a collection of clinical research studies1. Each of the clinical studies were conducted to understand the relationship between lifestyle behaviors (e.g. physical activity, nutrition, sleep) and health. The common characteristic among the studies was the focus on physical activity measurement using research-grade accelerometers alongside the measurement of key health outcomes, including clinically measured parameters, such as cholesterol, blood pressure, body mass index and presence of disease. The dataset included the vital status (dead or alive) of each participant with an average follow-up of 20 years, allowing for a deep dive into the relationship between physical activity and mortality outcomes.

Various methods were used for the analysis including classical actuarial mortality analysis, survival analysis and machine learning techniques. The key finding that steps per day stratifies mortality risk even after controlling for age, gender, smoking status and various health indicators was consistent across methods. We also learned that steps per day provides additional segmentation of mortality even after considering traditional underwriting attributes, such as smoking status, BMI, cholesterol, blood pressure and health history of diabetes, cardiovascular disease

and cancer.

Public health officials have long promoted active lifestyles to improve health and quality of life and to minimize risk of premature death, chronic disease and disability. Prior to wearable devices, there was no way for insurance companies to reliably measure physical activity for our customers. Few insurers ask for self-reported physical activity in the application and, if they did, it is difficult to confirm or control for the inherent subjectivity in applicant responses. With wearable technology, insurers can use activity data directly once a customer provides consent.

I see the following approaches to wearables-based programs within reach:

Accelerated underwriting: triage cases to allow applicants with favorable activity data to qualify for the best risk classes, mitigating mortality risk.

Traditional full underwriting: use wearable data as additional underwriting criteria, improving mortality experience.

Continuous engagement: promote healthy lifestyles, improving persistency and health.

Expanding insurability: improve offers to individuals who would otherwise have been declined or substandard, expanding insurability and better matching risks to premiums.

Consumers are accustomed to using mobile apps to share and obtain information, connect with people, shop, and to facilitate payments. We do this because it streamlines tasks and connects us with others. Customers now expect to have a similar experience when interacting with a life insurance company. Wearables can help insurers to improve the customer journey by providing a faster, less invasive process for purchasing life insurance and continuously engaging customers throughout the policy lifetime.

Accelerated underwriting

The life insurance industry has experienced incremental innovation from the introduction of fluid-testing and preferred classes to the use of data sources that better assess mortality risk: motor vehicle records, prescription history, and mortality scores based on public records and credit attributes. Insurers have implemented various approaches to accelerate underwriting for individuals applying for fully-underwritten products who may qualify to have their medical exams and fluid-testing waived. When fluids are removed from underwriting it becomes important to optimize the use of available information and to incorporate new information to accurately classify risk. Physical activity data canbe added to the toolkit, alongside other data sources and predictive models, to enable high straight through processing while mitigating the additional mortality risk.

With an applicant’s consent, insurers can tap into historical wearable data at the time of application and utilize a triage approach to quickly determine whether the data indicates a healthy lifestyle. Customers with favorable wearable data can be accelerated to the best risk classes while those with less favorable attributes would require additional underwriting, or could only quality for standard rates. When used in combination with a predictive model and/or underwriting rules engine, this approach can reduce time to issue from 30 days to mere minutes. Healthy consumers who are unwilling to deal with the inconvenience of the fully underwritten process or the higher price of simplified issue products will now have access to life insurance simply by providing their wearable data.

Traditional full underwriting

Another evolution is to use wearable data as additional underwriting criteria, improving mortality experience. Fluidless underwriting may not be an option for all applicants, especially those at older ages, higher face amounts or with medical conditions that require careful review. Wearable data can supplement existing information and provide insight into the risk factors that can further segment risk.

In addition to step counts, research indicates that resting heart rate and the duration and quality of sleep are associated with health and mortality outcomes2. These attributes can be used to segment risks in the same ways that BMI, blood pressure, cholesterol, personal and family history are used for preferred risk classification.

Algorithmic underwriting using sophisticated predictive models is already underway. As experience emerges, wearable data will be incorporated in these models to predict mortality risk for insured lives. Over time, the availability of rich wearable data coupled with artificial intelligence systems will help us uncover new insights on mortality risk and tailor life insurance premiums to the risk and behavior of each individual.

Continuous engagement

Wearables might have the largest appeal to Millennials who are connected to one another via their devices and who seek more personalized experiences. The technology serves as platform to raise awareness and encourage healthy lifestyles. Wearables provide a means for life insurers to continually engage with their policyholders, moving from infrequent touchpoints to daily interactions. This cultivates a relationship where the policyholder and life insurer are partners in health and challenges the insurer to communicate with their policyholders more effectively. This is a new way of thinking for both insurer and customer and can fundamentally change life insurance.

One likely impact is improved “stickiness” of the life insurance relationship, including improved persistency. Another is potentially improved health outcomes, as insurers can help our customers make better choices. Some early adopters have begun health and fitness-based rewards programs that incentivize customers to make healthy lifestyle choices by winning rewards or points that can be redeemed for prizes, coupons, or even reduced premiums.

Personalized messages on the wearable device can assist individuals to stay on track with their health goals and alert the customer and insurer if there are potential adverse signs. With wearables, insurers can play a pivotal role in motivating and nudging their policyholders in the right direction. The insurer’s and the policyholder’s interests are aligned – healthy behavior leads to improved longevity for the policyholder and improved outcomes and profitability for the insurer.

Expand insurability

Last but not least, wearables can make a difference in expanding insurability by improving offers to individuals who would otherwise have been declined or substandard while better matching risk to premiums. Today, most programs are geared towards individuals that are already very healthy, in effect, cherry picking the best risk. As the basic reason for protection insurance is for social good, there is a strong argument for underwriting to be more inclusive. Some individuals who are substandard risks or currently uninsurable may, in fact, lead healthy lifestyles that differentiate them from

others with similar medical conditions.

For example, today all else being equal, highly obese individuals may at best qualify for a substandard class. Wearable devices can identify those who lead healthier lifestyles or those that are achieving positive changes. These individuals should be eligible for better premiums. This can also incentivize substandard lives to improve their health by empowering them to make small but meaningful changes, and links insurance pricing to behavior that an individual has control over. Wearables can provide real-time feedback and motivation, turning small changes into new habits that will control illness and improve outcomes.

Challenges

As with all things new, bringing wearables into life insurance is not without challenges.

Insurers adopting a wearables-based program should be transparent about privacy, including what information is captured, stored and shared, and how the data is used. It goes without saying that insurers must obtain consent and the appropriate authorization from their customers before accessing their personal information.

Consumers understand the value of their data and may be more apprehensive of sharing personal information. Wearable technology provides biometric data akin to an individual’s medical history. Insurers have a long history of using sensitive personal medical information while maintaining the highest standards for confidentiality and security. We must demonstrate the value of wearable data using sound actuarial principles and expected experience in order to keep consumers’ trust.

It’s also important to note concerns around discrimination, equity and regulatory requirements, as these programs could penalize individuals without the ability to devote adequate time to daily physical activity. At the start, wearables programs will rely on voluntary participation until there is wider adoption. Insurers need to carefully design the program to protect against anti-selection or fraud as there will be individuals who modify behavior for a short period to appear to be more active than they are. It would be prudent to require several months of historical data when used for underwriting or pricing.

On the technology front, insurers need to monitor the consistency and reliability of data from various wearable devices. Device manufacturers are working to improve measurements to prevent incorrect readings such as vigorous hand movements misinterpreted as steps. Insurers must also ensure that they have the infrastructure to ingest the massive volumes of data that will accompany wearable data. Cross function teams including underwriters, actuaries and data scientists will need to collaborate to make sense of this information and to drive actionable insights. These insights will enable the industry to create standards for wearable data and reach a convergence of opinion similar to where we stand with conventional underwriting.

What’s next

In today’s environment of rapid innovation, life insurance companies are competing with not only peers, but with start-ups, third-party solution providers and groups outside the industry, who recognize the potential for disruption. Despite this, life insurance has remained relatively unchanged.

Imagine a world where wearable devices are as ubiquitous as mobile phones are today: they will be embedded in our daily lives, unobtrusive, provide us with meaningful instantaneous feedback, and connect to other devices as well as service providers - including our insurance company. We all have affordable life insurance, underwritten without hassle with a personalized policy linked to our lifestyle.

Wearables presents the perfect opportunity for the incumbent insurers to innovate, transforming the management of preventable and chronic disease while offering better prices and improved risk segmentation.

“Resting heart rate and all-cause and cardiovascular mortality in the general population: a meta-analysis”: https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4754196/

Contact the Author:

Newsletter

properties.trackTitle

properties.trackSubtitle