Of all the documents a life insurance underwriter sifts through for each application, such as insurance lab test results, paramedical exams, medical records, prescription histories, driving records, and credit reports – medical records are by far the gold standard for understanding risk. It provides an underwriter not only with a rich overview of the current health status of the applicant, namely any medical conditions and their respective durations and severities, but also reveals more complex risk factors.

These additional elements may cover family history, the applicant’s behavior (adherence to medication schedules or efforts made to improve his or her conditions), and other diagnostic or preventative health measures. These details allow underwriters to make a holistic and nuanced assessment of an applicant’s risk. However, this crucial piece of the underwriting process is also one of the costliest in terms of time spent – and is positioned for transformation through data science and machine learning.

Medical records are not only a crucial piece of the underwriting process but also one of the costliest in terms of time spent – positioned for transformation through data science and machine learning.

Challenge of the Attending Physician Statement

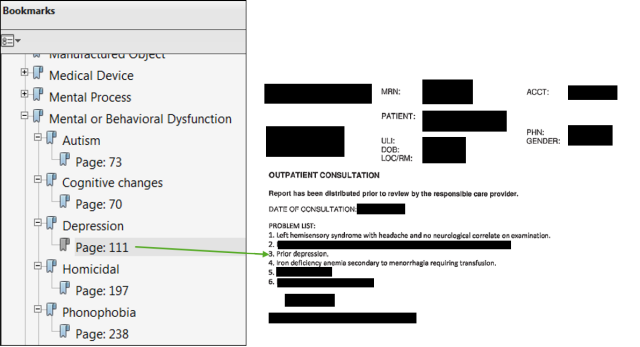

Medical records assessed for life insurance today are in the form of scanned PDFs that underwriters call attending physician statements (APS). These scanned paper documents or other printouts can be hundreds or even thousands of pages long and can encompass doctors’ typed notes, handwritten annotations, images of charts, lab test results and pathology reports. What makes these scanned pages particularly challenging to digest is that the contents aren’t arranged in standardized formats (meaning they cannot be easily classified into different medical document types). Pages are not necessarily presented in chronological order, and the documents cannot be digitally searched for relevant terms or sections.

The range of information and lack of standardization has traditionally forced the reading trajectory of an underwriter to be one that passes through each and every page from start to finish, unable to predict in advance which pages are more salient than others. Underwriters must page through hundreds of poorly scanned images while trying to quickly but thoroughly identify key words and sections in seconds. Not only does this process come with a steep learning curve, but it results in wasted time reviewing pages that are redundant and irrelevant.

There are also consequences for resource allocation since the length and scan quality of the APS can have more influence on the total review time than the complexity of the medical case itself. Ideally, more complex cases should be allocated to more experienced underwriters, but the length and quality of the images make matching the APS to the appropriate underwriter difficult and inefficient.

Transformation through Machine Learning

Machine learning, a subset of artificial intelligences, tackles these challenges in several ways. First, images are transformed into text, which is a more structured and usable output. Digitization, more specifically known as optical character recognition (OCR), converts images of text into characters that can be parsed by a computer. Then, various linguistic and medical knowledge models and tools can be applied to the digitized text.

Digitization, however, is only the first step. The next efficiency machine learning can add is triaging cases by medical complexity. Digitized medical records can be consumed by various decision models, which have demonstrated great success in predicting declined cases and identifying key impairments such as diabetes, cancer and coronary disease. These models have profound benefits for streamlining underwriting resource management.

The highest cost to underwriting is time spent per case, which often comes from manual review of medical records. The cost is especially detrimental in the case of declines, since the relevant parts of a long APS often boil down to just a few key declinable factors, and any extra time spent reviewing cannot generate new business.

Underwriting management can leverage triage models by assigning cases tagged as likely declines by a predictive model to junior underwriters for quick review while deploying seasoned underwriters to more ambiguous and complex cases. Similarly, impairment tagging predictive models can help to shift resources to cases that require more scrutiny.

Transforming the Way Underwriters View APS Records

The most exciting product of machine learning is the potential to transform the way underwriters view and consume medical documents entirely. Digital underwriting platforms have allowed collection of underwriting activity data – what data scientists call telemetry data – on how real underwriters review APSs. This data reveals the keywords and medical sections that underwriters focus on, and this insight is captured in machine learning models that use this experience to assign importance to medical concepts and pages in new APSs.

Future of Medical Records in Underwriting

Advances in machine learning are transforming medical records from haphazard combinations of notes and images into efficient data workflows where applications are automatically triaged. Today’s underwriters can digitally search documents with the benefit of intelligent guidance, leading them to the most relevant medical evidence. Ultimately, machine learning helps underwriters arrive at the right risk decision for each applicant with streamlined effort. Munich Re leverages machine learning for facultative underwriting and is able to assist carriers with assessing the benefit of digitization and machine learning models for their life underwriting process. Our Integrated Analytics Department has the expertise to build custom models and digital solution — and can assist in incorporating digitized documents and decisioning into your existing underwriting workflows and software.

Contact the Author

Related Content

Newsletter

properties.trackTitle

properties.trackSubtitle