Munich Re Life US conducted an accelerated underwriting survey to capture new and emerging trends in the U.S. individual life accelerated underwriting market.

COVID-19 Impacts

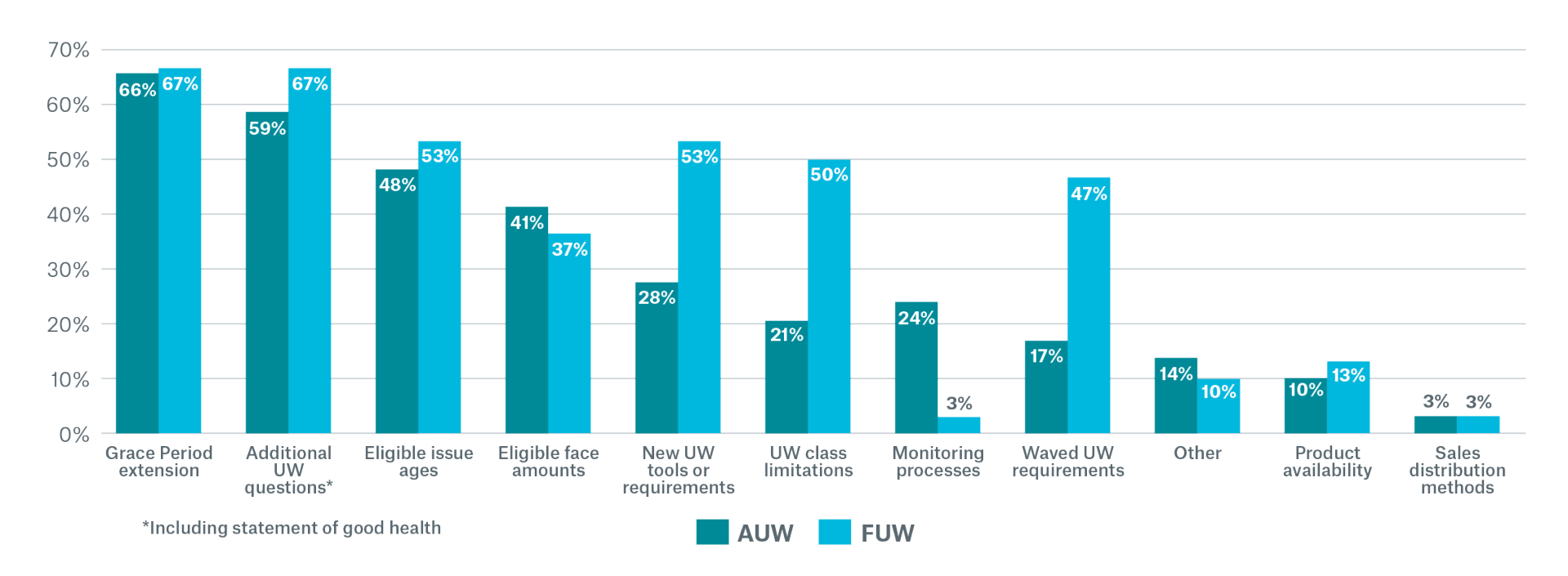

In order to assess the pandemic’s impact on the life insurance industry, we asked participants to identify and provide details on all modifications that were made to their company’s accelerated underwriting and full underwriting programs (FUW) in response to COVID-19. The intent of the questions was to compare and contrast the changes made to both of the underwriting paradigms. See Figure 1 for a comparison of results.

The most common modifications made by the majority of carriers under both underwriting paradigms were grace period extensions (as mandated by state requirements) and additional underwriting questions, including COVID-19 exposure and a statement of good health.

Where we see the biggest disparity between traditional and accelerated underwriting program modifications is around the adoption of new underwriting tools or requirements, underwriting class limitations and waiving of existing requirements, all of which were more prevalent on the fully underwritten side. In many instances, these FUW modifications were temporary and modeled after carriers’ AUW eligibility limits and their current or planned AUW requirements. In particular, we saw carriers moving quickly into production with new tools such as medical claims data, electronic health records, and clinical lab data, which otherwise would have been evaluated at a more deliberate pace. These new data sources were intended to serve as a substitute for traditional exams, which were not easily accessible during the initial months of the pandemic’s emergence in the U.S.

The following sections explore noteworthy trends observed specifically on the accelerated underwriting side.

Eligible Issue Age and Face Amounts

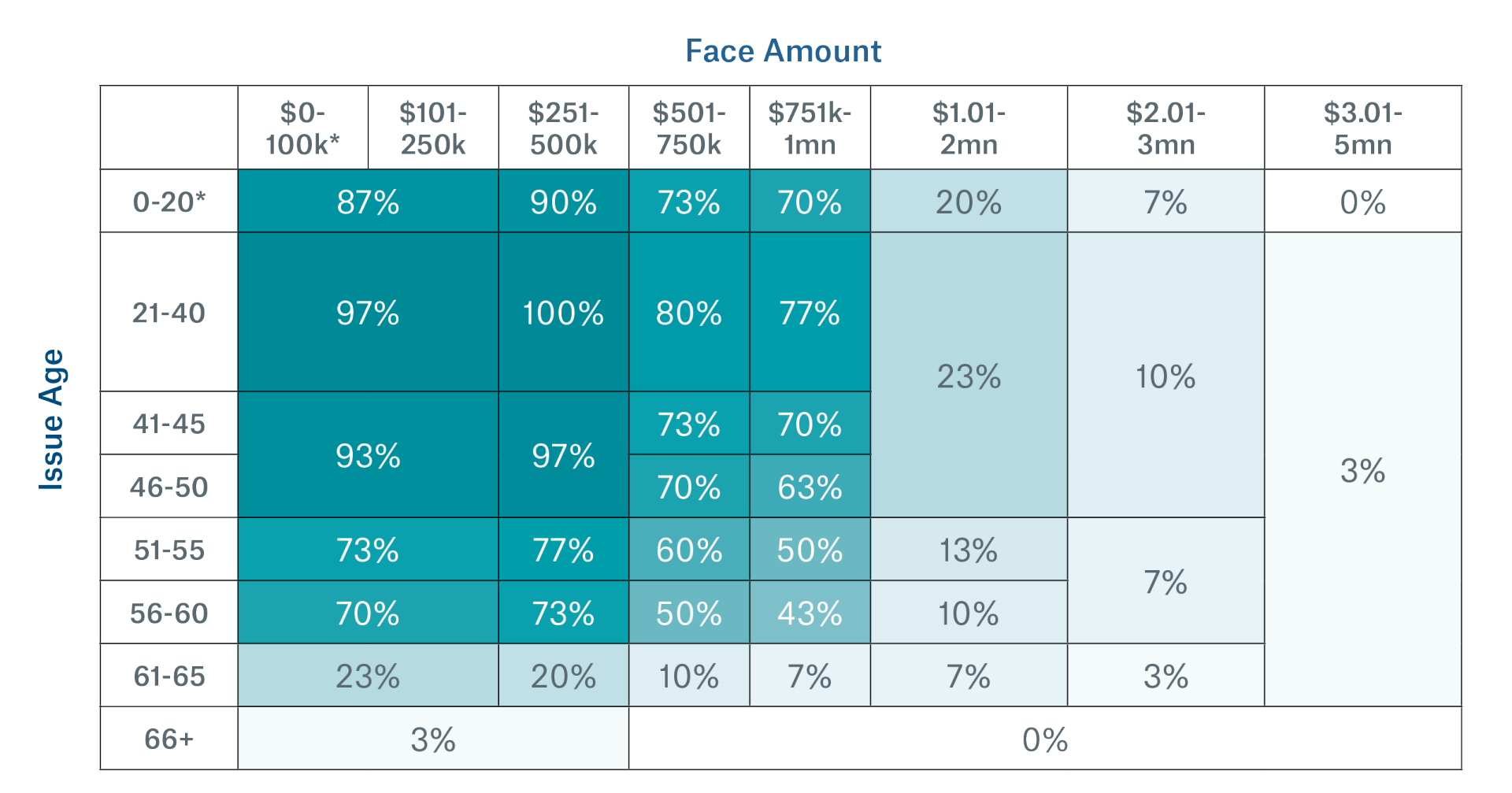

Figure 2 provides a high-level visual of where the industry was in early 2020, specifically, the proportion of companies offering Accelerated Underwriting to applicants within each five-year age band and face amount groupings. All 30 companies surveyed were offering AUW to applicants between 21-40 and $250k-$500k, then we see a gradual drop off of companies starting issue age 40 and face amount $500k, with the steepest drop off at issue age of 60 and face amount $1m (the median upper limits).

While there has been a noticeable shift in maximum face amount offerings in recent years, it’s important to keep in mind that not all AUW face amount bands are available to all AUW eligible issue ages, as evidenced by Figure 2. In addition to offering a banded eligibility structure, as reported by one-third of companies, some programs may pair high maximum issue ages and face amounts with conservative underwriting criteria, which is often accompanied by lower accelerated offer rates. This is often an intentional marketing strategy that allows companies to advertise lower premium rates or higher face amounts to attract a larger applicant pool.

Arguably, what resulted in the most attention from the industry at the time changes were being made, were AUW face amount expansions. While initially considered “temporary,” these face amount increases were deemed necessary by many carriers in order to underwrite applicants at higher face amount bands that would have been served by full underwriting under normal circumstances.

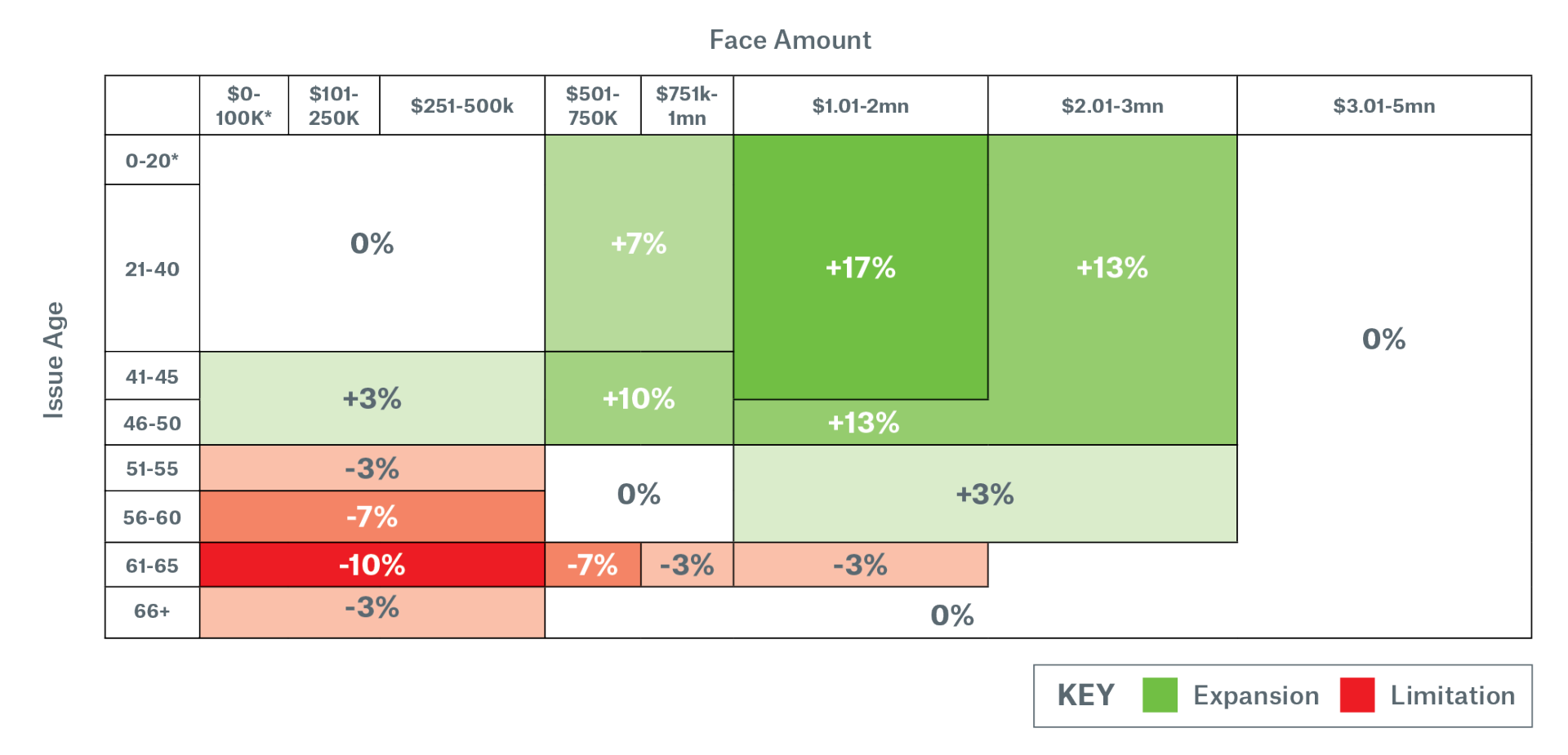

For a more detailed visual of the COVID-19 impacts on AUW age and amount limits by percentage of companies, see Figure 3, which can be compared against Figure 2 from earlier in this section of the report.

From the visual above, we see a mix of AUW issue age limitations at the oldest ages and expansions at the younger AUW issue age limits, particularly at the higher face amounts. We see a clear trend in that the most common modification was an increase in AUW eligible face amounts from $1m up to $2m or $3m maximum face amounts, primarily in the under 50 issue age cohorts. To the extent that we are aware of a company’s reason for AUW eligibility changes, this view excludes any pre-planned 2020 eligibility changes that were decided on prior to the emergence of COVID-19.

Underwriting Tools

Underwriting Classes

The risk class structure of accelerated underwritten products continues to expand, with 67% of companies now offering the same number of standard and preferred risk classes as their traditionally underwritten products, up from 50% of companies in 2018.

Most commonly, four non-tobacco (NT) classes were reported for both the traditional and accelerated underwriting paths, while two tobacco (TB) classes was the most common for both FUW and AUW. The vast majority of AUW programs, 83%, now allow tobacco users to go through their AUW program, up from 67% in 2018.

One AUW risk class feature that has remained stable since 2018 is the availability of substandard classes which approximately one-quarter of AUW programs continue to offer. However, for those programs that do accelerate substandard risks, more limitations are placed on the substandard table ratings offered, with the median AUW substandard table rating available up to table 4 (D), compared to a median substandard rating of table 15 (O) on the FUW side. This likely explains why we saw a lower prevalence of COVID-19 driven “underwriting class limitations” in accelerated underwriting compared to traditional underwriting, as it was common for many companies to temporarily restrict offers to the most impaired substandard risks.

Monitoring

All the companies that responded to the 2020 survey reported having a monitoring control put in place, whether it be random holdouts (RHOs), post-issue APS (PIA) audits, or other post-issue techniques. The most commonly used “other” post-issue tools include MIB Plan F, followed by Rx post-issue check, and underwriter review.

Random holdouts are a monitoring technique in which cases in the accelerated underwriting workflow are randomly selected to go through the traditional underwriting process, in order to compare the FUW assigned risk class to that of the AUW outcome. The majority (57%) of companies conducted random holdouts as of June 2020. The median and most common RHO rate is 5%, or 1 out of 20 cases, with 7.1% being the average holdout rate reported in 2020.

Similarly, we also see 57% of companies conducting post-issue APS audits, with an overlapping 23% performing both RHO and PIA techniques. The median and most commonly reported PIA audit rate was 10%, or 1 in 10 issued policies, while the average APS audit rate was 17.3%. Some companies perform APS audits instead of RHOs because they don’t offer a fully underwritten alternative. Others prefer the post-issue audit process because they are less impactful to the customer experience, with the exception of material misrepresentation that can later lead to a live rescission of the AUW issued policy.

Compared to 2018, we have seen a notable shift away from carriers performing a combination of both RHO and PIA monitoring practices towards just one of these auditing methods, often supplemented with other post-issue techniques, as listed above. Some companies intentionally dialed down their initial monitoring efforts once they were out of the pilot stage and gained comfort with the emerging trends, while others scaled back monitoring efforts directly as a result of COVID-19. As seen in figure 1, “monitoring processes” was the item with the largest differential in AUW program modifications over FUW program modifications. This can be explained by the same reason why “waived underwriting requirements” were more prevalent than the traditionally underwritten side. Traditional insurance labs were not easily accessible in the initial months of the pandemic. As a result, many AUW programs paused their existing monitoring processes or temporarily replaced them with alternative data sources.

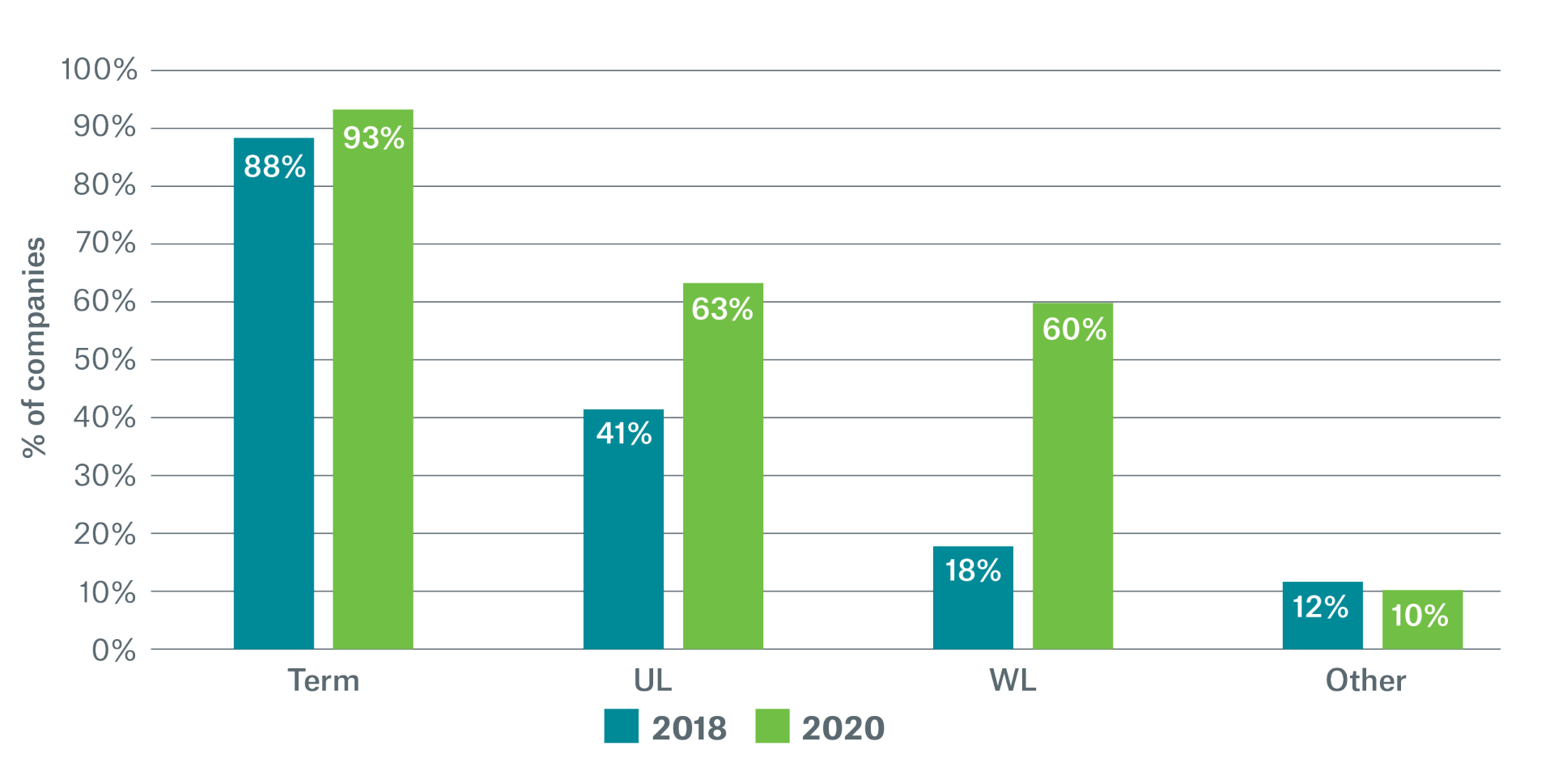

Product Availability

Sales Distribution Methods

Conclusion

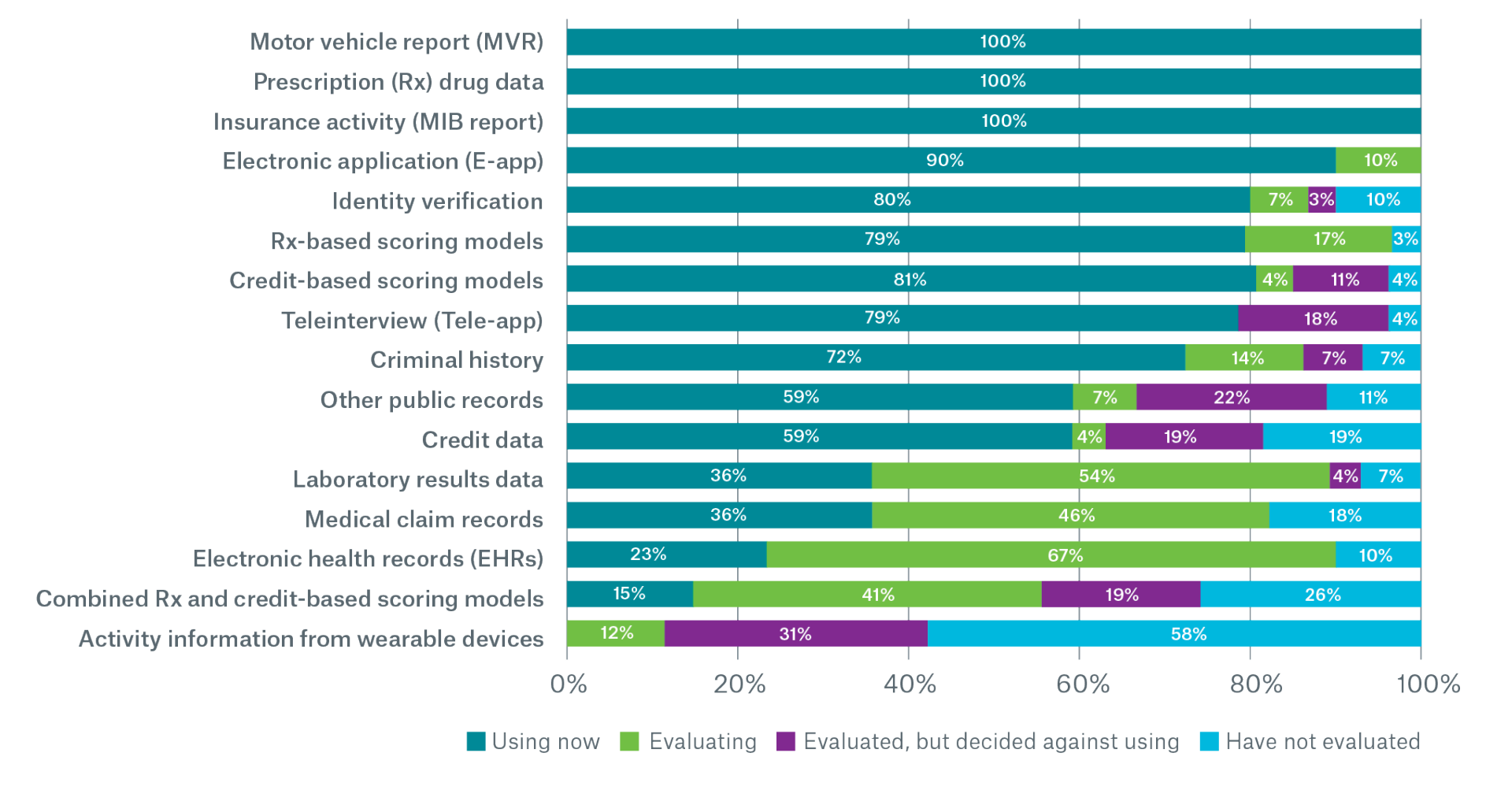

It’s clear from the survey trends that the U.S. accelerated underwriting landscape continues to change rapidly, driven in part by the underwriting limitations put in place by COVID-19. Companies are expanding their AUW programs more quickly than ever in terms of face amount eligibility, number of risk classes, product types offered, and distribution channels, making this “new underwriting paradigm” more closely resemble that of full underwriting. At the same time, we are seeing the evolution and rapid adoption of more underwriting tools that are still somewhat of a “proof of concept” and have more varied use cases than we have seen from the “staple” AUW tools that remain in place since the time of our last survey. At the time of adoption, these “staples” (Rx, MIB, MVR, credit-based) were better studied and understood from a mortality-impact perspective than some of the more recent tools being tried.

Simultaneously, we see traditional underwriting programs adopting new data driven underwriting tools at break-neck speed, driven in large part by the underwriting limitations put in place by the COVID-19 pandemic. While the industry was slowly moving in this direction, COVID-19 essentially “hit the gas” on blending these two underwriting paradigms by further blurring the lines between accelerated and traditional underwriting. Which ultimately begs the question, are these temporary changes here to stay?

Contact the Authors

/Lisa%20Seeman.jpg/_jcr_content/renditions/original./Lisa%20Seeman.jpg)

Related Content

Newsletter

properties.trackTitle

properties.trackSubtitle