properties.trackTitle

properties.trackSubtitle

Using wearables for insurance risk assessment

Wearable technology refers to electronic devices with sensors, typically worn on the body, that collect and deliver information about their surroundings. Generally, the wearable device is a wristband or watch, although the technology has expanded to jewelry, glasses, clothing, and shoes. The accelerometers in activity trackers are also found in smart-phones, allowing phones to track user activity even without a separate wearable device. These devices can be simple tools for tracking metrics associated with physical activity: step count, speed, and minutes of moderate and vigorous activity. Some models also capture heart rate, sleep patterns, and calories burned.

Roughly three-quarters of Americans (77%) own a smartphone and half (49%) own a wearable device.1,2 At the same time, sedentary behavior is associated with higher mortality rates, regardless of age, gender, race, and body mass index. As the wearable and smartphone markets grow, there is potential for incorporating physical activity information into the life insurance process to enhance customer experience while improving risk selection. Applications can include:

- Accelerated underwriting: triage cases to limit sedentary applicants from qualifying for the best risk classes, mitigating mortality risk

- Traditional full underwriting: use physical activity as additional underwriting criteria, improving mortality experience

- Customer engagement and awareness: develop rewards programs to cultivate healthy lifestyle choices, resulting in reduced healthcare expenses

Companies interested in adopting a wearables-based program should be transparent about privacy, including what information is captured, stored, shared, and how the data is used. It’s also important to note concerns around discrimination and equity, as these programs could penalize individuals without the ability to devote adequate time to daily physical activity. Still, as physical activity contributes to healthier lifestyles and longevity, incorporating wearable data in the life insurance market is an innovative means of managing risk.

Executive summary

Munich Re assessed the effectiveness of physical activity as measured by wearable sensors in stratifying the mortality risk profile of a U.S. population-based dataset provided by Vivametrica. Munich Re examined the dataset, performed classical actuarial

mortality analysis and used survival analysis and machine learning techniques to evaluate the extent to which physical activity predicts mortality.

Wearable sensors measure the level of physical activity through step count and minutes of moderate to vigorous activity per day. Munich Re’s analysis found that steps per day can effectively segment mortality risk even after controlling for age, gender, smoking status and various health indicators. Insurers looking to improve customer engagement, increase healthy lifestyle behaviors or incorporate new underwriting data in evaluating risks may want to consider using physical activity metrics from wearable sensors at various touchpoints of the life insurance process.

Data and extrapolation to life insurance

Vivametrica compiled a rich dataset from several clinical research studies performed between 1988 and 2004. Each of the clinical studies were conducted to understand the relationship between lifestyle behaviors (e.g. physical activity, nutrition, sleep) and health outcomes including disease and mortality. The common characteristics among the studies was the focus on physical activity measurement alongside the measurement of key health outcomes, including clinical measured clinical parameters and identify presence of chronic disease.

This de-identified dataset is comprised of 4,909 deaths on 14,192 individuals. The data collected in these studies include:

- Demographic information: age, gender, family income to poverty ratio (a measure of wealth)

- Measurements of BMI, waist size, cholesterol and blood pressure

- Physician-assessed indicators of cardiovascular, cancer and diabetes status

- Self-declared smoking status, alcohol use, drug use and family history of diabetes and cardiovascular disorders

- Step count and minutes of moderate to vigorous activity measured over a minimum of 7 days using research-grade

hip-worn accelerometers - Follow-up months since study entry date and the vital status (death or alive) at follow-up. Deaths were also confirmed by matching individuals to the Social Security Death Master. The average follow-up period is 20 years.

Munich Re evaluated the characteristics of the dataset to address concerns that clinical research studies may skew towards unhealthy lives, limiting the applicability of the findings to a life insurance population. The clinical research studies used by Vivametrica employ rigorous recruitment protocols and enforce requirements for eligibility, to ensure that the samples include healthy individuals as well as those with a disease or health risk. All of the clinical studies included in the Vivametrica database were subject to population-based sampling methods. This means that the data is truly representative of the characteristics of the general U.S. population. In all studies, participants’ health was assessed by doctors or trained health care professionals.

Vivametrica provided sample weights for each individual based on several variables including age, gender and geographic location. This weight is a measure of the number of people in the population represented by each study participant. The data was weighted to produce a dataset representing an unbiased general U.S. population.

Munich Re also simulated an insurable population by including lives with:

- Family income to poverty ratio greater than one as a measure of wealth or face amount

- No history of cardiovascular disorder or cancer (other than skin)

- BMI, blood pressure and cholesterol values within insurable limits

The insurable population is comprised of 2,125 deaths on 8,173 individuals.

Classical actuarial methodology

Munich Re performed a classical actuarial actual to expected mortality analysis of the overall population-based dataset. To do this, we used an expected mortality basis taken from the Human Mortality Database U.S. Life Tables, which represents U.S. population mortality split by age, gender and calendar year. The expected mortality basis for the insurable population was taken from the 2008 VBT primary select & ultimate ANB tables split by age, gender and smoker status.

Munich Re completed analyses of relative actual to expected deaths (A/E) for both populations by various attributes to assess how mortality risk stratification by physical activity is influenced by these factors.

Overall results

Figure 1 demonstrates that steps per day stratifies mortality risk. Lives with sedentary and low steps per day have much higher mortality risk, while moderate and high steps per day correspond with lower mortality risk. Sedentary behavior is indicative of relative mortality that is over 3 times higher compared to active behavior as measured by steps per day. The pattern is observed for both the general population and the insurable lives.

We found minutes of moderate to vigorous activity to be highly correlated with steps per day, with fewer minutes of moderate to vigorous activity associated with higher relative mortality while higher minutes have lower relative mortality. The analysis that follows is focused on steps per day for the population of insurable lives.

By age

Figure 2a summarizes the distribution of average steps per day by age group. Not surprisingly, the proportion of moderate and high steps decreases as ages increases, which means that average steps per day is higher for younger ages. Figure 2b demonstrates the mortality risk segmentation of steps per day across age bands. All age groups follow the same pattern, where mortality risk is much higher for those with sedentary and low steps. We also see that mortality differentiation by steps per day is more pronounced under age 65. Individuals aged 20-50 with sedentary steps have relative mortality greater than 5 times and are not shown on the chart. We assume this is due to the small number of cases in this segment and that sedentary behavior at younger ages is indicative of other health issues.

By gender

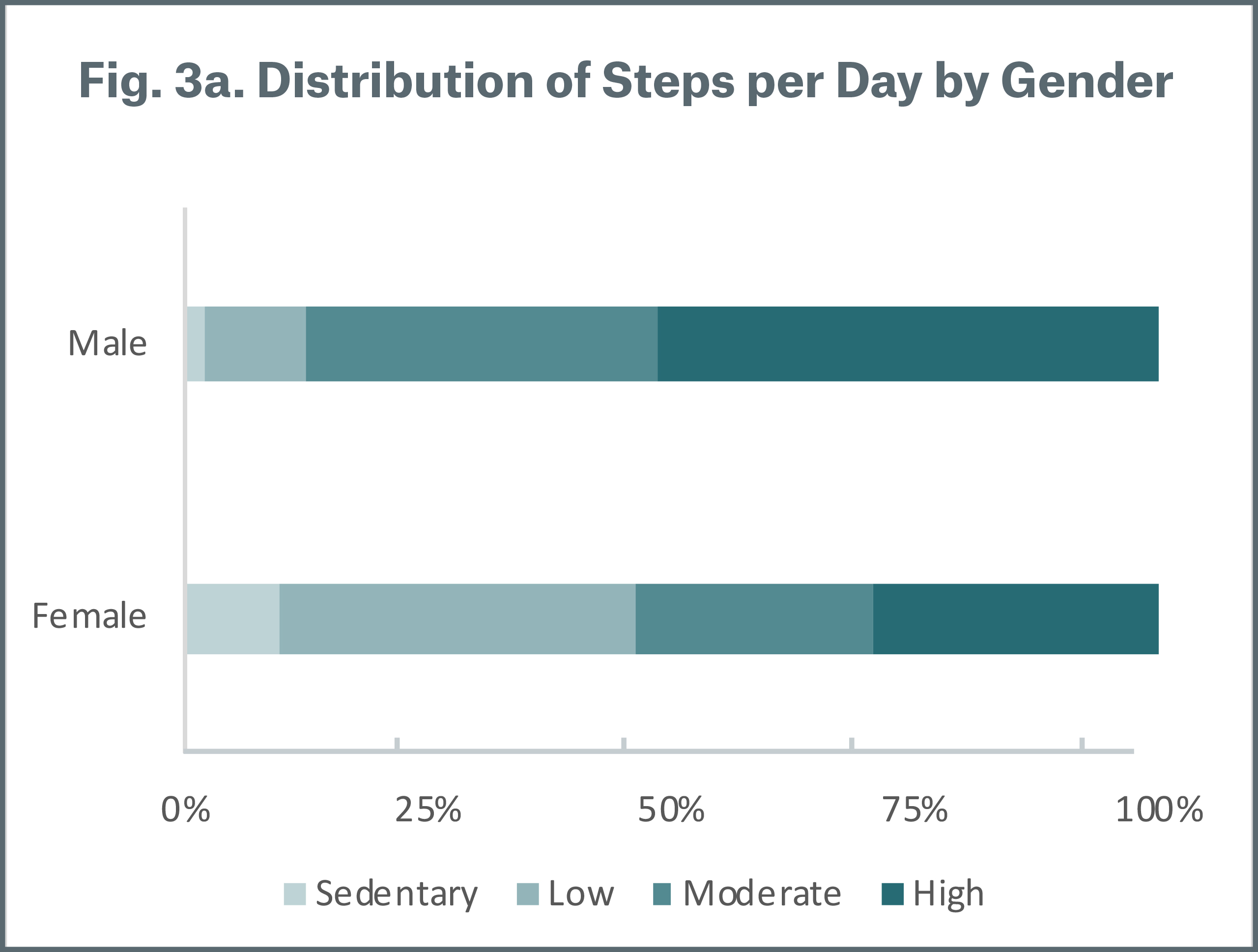

Figure 3a illustrates that males have a higher proportion of moderate and high steps compared with females; average steps per day is lower for females. Figure 3b shows that both males and females with moderate and high steps have better relative mortality. For males, the differentiation is most pronounced between low to moderate steps while for females this occurs between sedentary to low steps per day. This suggests that when steps per day are used for risk segmentation, different thresholds should be used to define physical activity levels for men and women.

By BMI

Figure 4a shows the distribution of steps per day by body mass index (BMI). As can be expected, obese individuals (BMI of 30+) have a higher proportion of sedentary and low steps. Figure 4b shows the relative mortality by steps per day and BMI ranges; obesity is associated with higher relative mortality. Steps per day shows a consistent pattern of mortality segmentation across BMI ranges, except for the small number of obese individuals with high steps per day.

By smoking status

From Figure 5a, we observe that the distribution of steps per day does not vary significantly by smoking status; current smokers at the time of the study measurement have a slightly lower proportion of higher steps per day. Figure 5b demonstrates that regardless of smoking status, relative mortality risk is higher for sedentary and low steps. One interesting observation is that non-smokers (both those who have never smoked and those who were prior smokers) with sedentary and low steps per day experience higher mortality than smokers with moderate and high steps.

Munich Re also reviewed several other variables provided by Vivametrica such as a wealth, cholesterol and diabetes. We found that steps per day effectively stratifies mortality across these attributes.

.jpg/_jcr_content/renditions/original./Figure-5a_distribution%20of%20steps%20per%20day%20by%20smoking%20status%20(2).jpg)

.jpg/_jcr_content/renditions/original./Figure-5b_Relative%20AE%20mortality%20by%20steps%20and%20smoking%20status%20(2).jpg)

Survival analysis

Complementing the classical actuarial mortality analysis, Munich Re applied predictive modeling techniques to evaluate the extent to which physical activity predicts mortality. Using the dataset of insurable lives, Munich Re built Cox Proportional Hazard Regression Survival Models and Random Forest Survival Models and compared various models with and without steps per day as a predictor. The table at right lists the predictors included in each model.

Figure 6 depicts the variable importance when including all available variables as predictors of mortality (Model C). Steps per day is a significant predictor of mortality and ranks as the second most important predictor after age.

One method to assess the predictive power of a model is using a goodness of fit metric such as area under the curve (AUC or Harrell’s C-index). A value of 0.5 (50%) implies the model prediction is no better than random guessing, while a value of 1 (100%) represents a perfect model.

Figure 7 compares the AUC for the four models. As expected, Model A with only four demographic questions has the lowest AUC. Model B represents the traditional underwriting paradigm, where demographic information, vitals, and family history are used to segment mortality. Model C includes the same factors as Model B with the addition of steps per day. Adding steps per day improves the AUC, indicating that steps offer predictive power for additional mortality segmentation on top of traditional underwriting attributes.

Interestingly, Model D, which includes only demographic information and steps per day, performs similarly to Model B, which incorporates traditional underwriting attributes. This suggests that in streamlined underwriting programs where exams and fluids are waived for a subset of applicants, steps per day can supplant some of the traditional underwriting factors in segmenting mortality.

It is important to note that the individuals in this dataset were not underwritten for life insurance, hence have no self-selection or anti-selection, and that the underwriting variables included in these models are not exhaustive. Nonetheless, the results here indicate that steps per day is a powerful predictor of mortality and can enhance risk assessment in fully underwritten and streamlined programs.

Summary

Based on our analyses of Vivametrica’s clinical research dataset, Munich Re concludes that there is strong evidence that physical activity as measured by steps per day can effectively segment mortality risk even after controlling for age, gender, smoking status and various health indicators. Steps per day is a powerful predictor of mortality and may be especially effective in identifying high mortality risk for sedentary behavior. A credible pool of life insurance applicants with historical wearable data and mortality outcomes would most accurately measure the impact of incorporating wearables in life insurance risk assessment. However, we believe the clinical data delivers robust support for using a wearables-based program to augment the current underwriting process, manage risk, and promote active lifestyles.

Insurers interested in adopting a wearables program should begin with a pilot to assess consumer adoption rates and to understand the physical activity characteristics of their customers. The pilot serves as a baseline analysis to support a more comprehensive customer engagement or risk assessment program. Munich Re can provide assistance in program development, measurement, and monitoring to carriers considering a wearables-based program in the life insurance process.

- http://www.pewresearch.org/fact-tank/2017/01/12/evolution-of-technology/

- 2016 PriceWaterhouseCoopers Consumer Intelligence Series report on wearables, https://www.pwc.com/us/en/industry/entertainment-media/assets/pwc-cis-wearables.pdf

- http://annals.org/aim/article-abstract/2653704/patterns-sedentary-behavior-mortality-u-s-middle-aged-older-adults

/Sandra%20Chefitz.jpg/_jcr_content/renditions/cropped.square.jpg./cropped.square.jpg)

Newsletter

properties.trackTitle

properties.trackSubtitle