properties.trackTitle

properties.trackSubtitle

Fraud: One of the most expensive challenges insurers face

Detecting potential fraud is a challenge for health insurers globally. Costing between 5% and 10% of an insurance company annual revenue, fraud has continued to grow, fuelled by rise of telehealth and telemedicine.

According to analysts, only a small percentage of medical claims are being properly examined for fraud, and those are mainly claims related to life and mortality benefits. On the other hand, medical claims are typically large volume and high frequency, which means they would need teams of experts to investigate them properly, resulting in higher costs and increased turnaround time. This is the area where SHIELD can add value by automating the medical adjudication of claims, and improving cost containment through detection of potential fraudulent cases.

Addressing your needs as an insurer

To optimize their health claims outcomes, insurers today need a new and modern approach that will automate their claims processing and lead to better decision making, faster claims responses and settlements, and more cost saving. With SHIELD you can:

- Improve your cost containment activities, leading to reduced claim costs and loss ratios

- Manage denials efficiently and transparently

- Improve turnaround times

- Increase customer satisfaction

- Strengthen compliance

The business challenges you face

As an insurer, you face challenges related to claims processing from the day a claim is received until the final stage of settlement. The most common challenges include:

- Limited capacity to investigate every suspicious claim

- Tight SLAs with medical providers for denial management

- Legacy system limitations

- Lack of meaningful, structured data

- Data protection laws that prevent use of data

- Constantly evolving fraud patterns

Put a SHIELD in place against fraud

SHIELD is a rules-based system that automated claims medical adjudication, detects potential fraud, waste and abuse, and justifies denials. It is built on a robust foundation designed to seamlessly integrate with both supervised and unsupervised AI models, ensuring adaptability and scalability for advanced machine learning applications.

SHIELD goes above and beyond what others provide

- Unlike other rules-based engines, SHIELD comes with standard rule sets for specific geographies but also gives insurers the flexibility to modify rules or add their own.

- Unlike other fraud analytics solutions, SHIELD not only detects potential fraud but can also approve or reject a claim, based on medical rules.

SHIELD includes rule types related to Age and Gender, Diagnosis and Regulatory and Coding System. It offers 37.000 rules out-of-the-box, plus an additional 1 million rules provided by Milliman.

SHIELD was recognised as a “Technology Standout” in Celent’s 2022 Health Insurance Fraud Detection Report, based on the sophistication and breadth of its technology.

SHIELD your company from fraud in these areas

- Outpatient

- In-Patient

- Dental

- Pharmacy

- Pre-Authorisations

SHIELD supports

- Health insurers

- Life and general insurers with medical portfolios

- Third Party Administrators (TPAs)

- Regulators

- Medical providers

Watch our exclusive webinar on-demand

How you benefit from SHIELD?

SHIELD optimizes and automates medical claims processing and lets you respond more quickly to claimants and resolve legitimate claims faster, leading to greater customer satisfaction.

More specifically, SHIELD provides:

- Increased capacity to investigate and detect anomalies and inconsistencies

- Enhanced SLA compliance

- Improved turnaround time and customer experience

- Easy integration with existing processes and systems

- Improvement in cost containment activities, leading to reduced claim costs and loss ratios

- Efficient and transparent denials' management

Key features & capabilities to manage your business

Expertise and technology behind the solution

SHIELD uses an engine that leverages rules developed by medical experts.

Its AI power is fuelled by an HDBSCAN density-based clustering algorithm and a LightGBM boosted tree model.

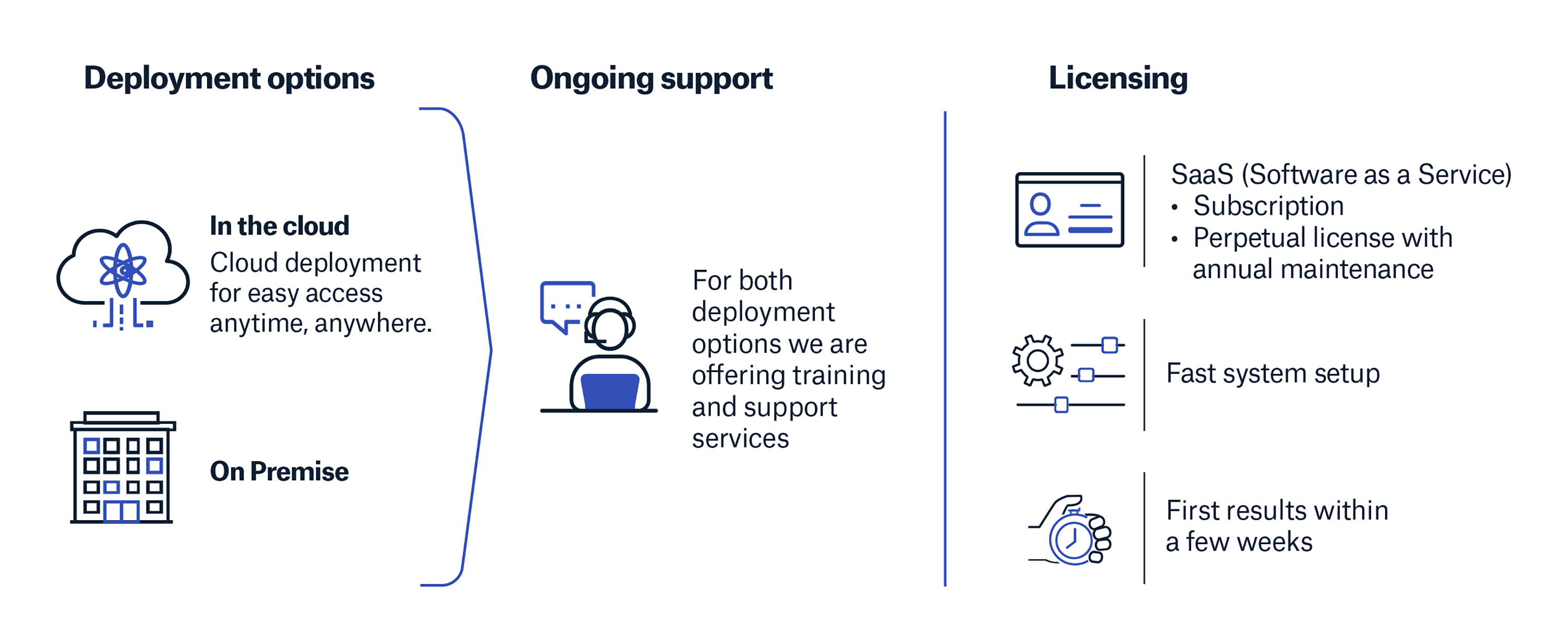

Deployment and licensing options that work best for your business

.jpg/_jcr_content/renditions/original./iStock-1280956095%20(Static).jpg)