HSB MGA & Embedded Markets

The future of insurance

properties.trackTitle

properties.trackSubtitle

Risk is continuously evolving, and the HSB MGA & Embedded Markets team works at the forefront of that evolution. Whether you’re looking to elevate your business through embedded insurance solutions that seamlessly integrate into your offering, seeking dynamic turnkey risk solutions that enhance your products, or you need creative capacity to drive your business, HSB wants to collaborate with you.

HSB, a part of Munich Re, is a leading multi-line specialty insurer and provider of inspection, risk management, and IoT technology services. HSB is a leading specialty insurance writer in the U.S. and is among the top cyber insurers in the country. Rated A++ (Superior) by AM Best, we have been revolutionizing insurance for over 150 years.

Applied innovation

The HSB MGA & Embedded Markets team can bring to bear expertise and product innovation for any of our specialty coverages in unique, creative, and nimble ways. HSB’s specialty insurance offerings include equipment breakdown, cyber risk, specialty liability, business interruption, and a range of other coverages.

As we discuss your needs and learn about your business model, a picture will often emerge of how specialty insurance can be used to differentiate your brand and enhance your capabilities. We customize coverage to dovetail with your offering - there’s nothing “off-the-shelf” about what we deliver. Ultimately, our goal is to create a lasting partnership by bringing our expertise and creativity to bear on your market needs.

Who we partner with

Insurance solutions for MGAs

HSB: A trusted partner in pioneering the future of insurance

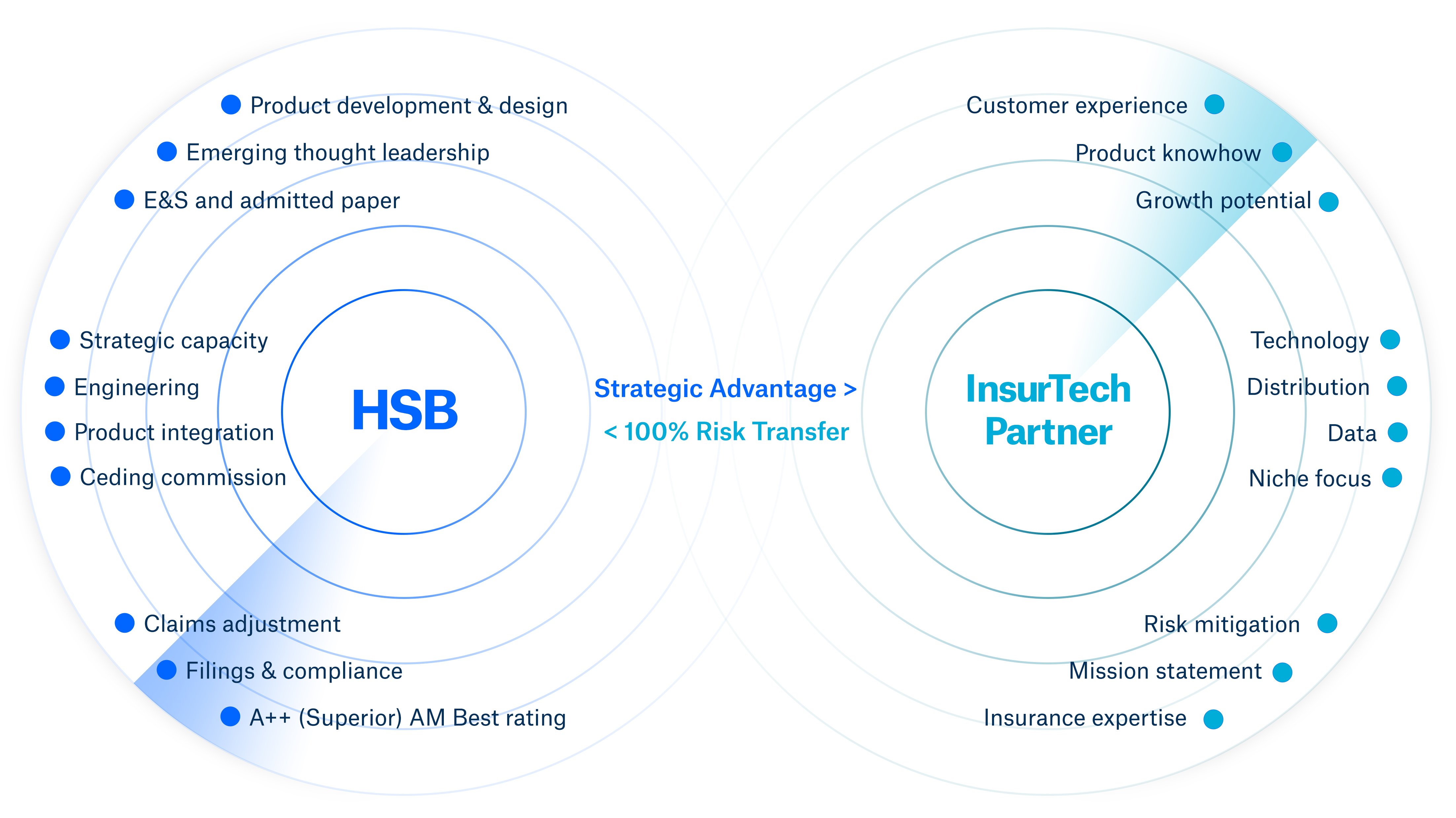

The synergistic relationship between HSB and strategic MGA partners allows HSB to enable the next generation of insurance products while managing risk and distribution channels. Partners benefit from HSB’s strategic capacity, solid financial and risk management capabilities, and expertise.

How? We work directly with established InsurTechs and startups, as well as brokers who have a dedicated InsurTech or MGA focus.

Embedded solutions for non-insurance companies

How? We build risk solutions around your product:

Risk is evolving. So is HSB.

Would you like to know more? Get in touch.