New mobility ecosystem

Preparing insurers and consumers along the entire value chain for the mobility of today and tomorrow.

properties.trackTitle

properties.trackSubtitle

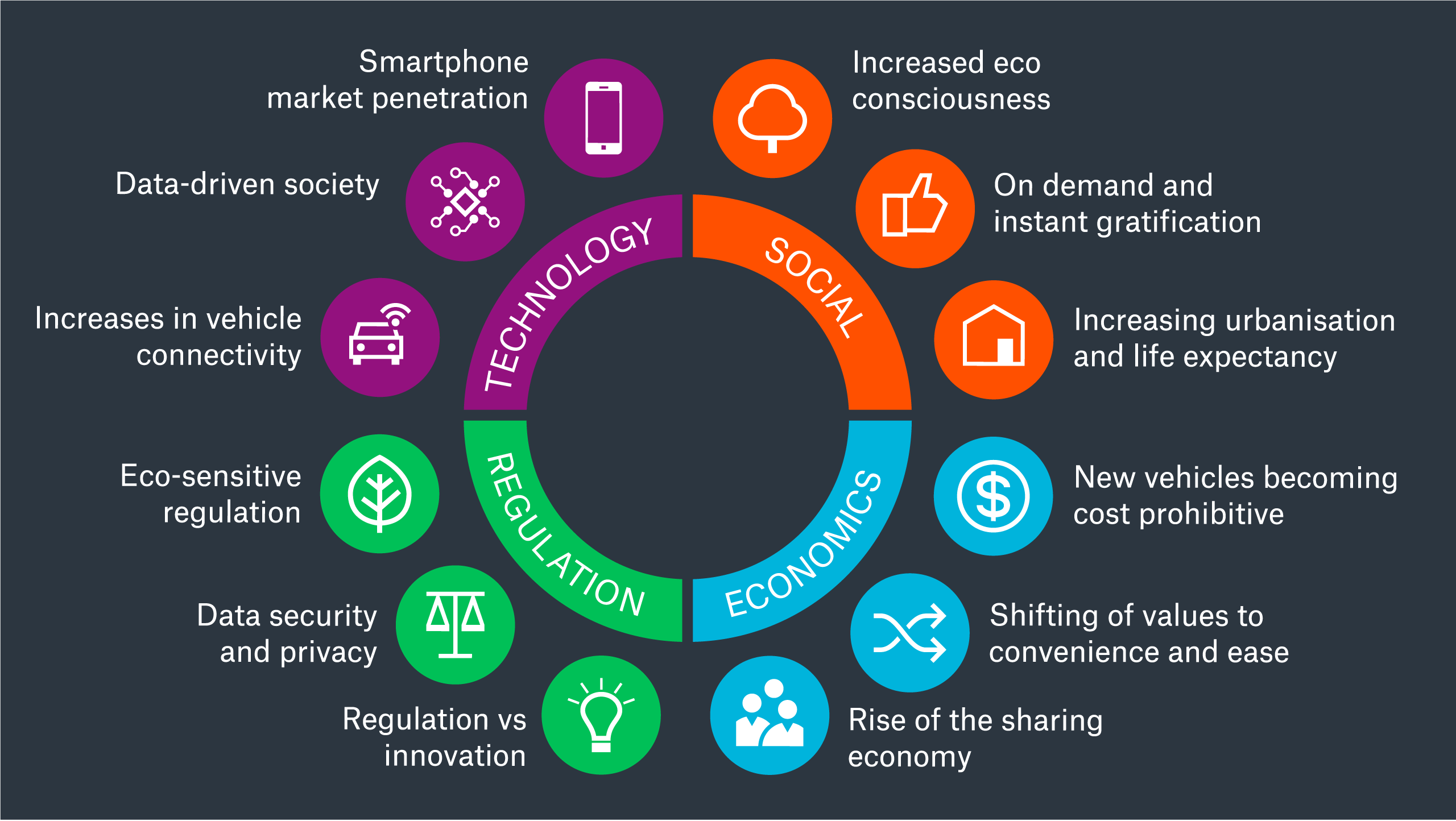

The world of mobility is changing at a rapid pace

Factors influencing the trajectory and pace of change

New mobility insurance trends

Get in touch

Click any topic to explore further:

Connected usage-based insurance

As the mobility behaviour of consumers changes through a more connected, shared and on demand transportation offering, privately-owned cars are becoming more connected and intelligent. Correspondingly, connected insurance and telematics solutions are undergoing significant growth. And the capacity to capture, store and analyse data, behavioural and mobility-related, generated from connected vehicles will be a key enabler in developing still further in the years ahead connected usage-based insurances (UBI) and pay as you drive (PAYD) products. Properly understanding the new risks inherent in connected mobility will permit higher profit per policy through risk-predictive behavioural scoring applied in the pricing process. It also will open up new touchpoints with customers, which will lead to higher brand stickiness and retention and, not least, significantly streamline the claims process.

Challenges: Capabilities for processing data generated through new sources

Sensors, integrated in both vehicles and mobile phones, are moving into the mainstream, creating significant data. Do we have the right capabilities to capture, analyse and act on this new data for mobility insurance purposes?

Our offering

Our solutions include strategic and operational consulting, products, pricing, analytics and technology via our own solutions and strategic partnerships.

Learn more about how we can work with you on connected mobility insurance solutions:

Mobility as a service

New mobility platforms are driving a shift away from personally-owned modes of transport towards mobility solutions consumed as a service. Examples include:

- ride hailing,

- carpooling,

- subscription-based car ownership, and

- micro mobility, such as electro scooters.

An insurance is fundamental to the business models of all of these new mobility platforms, be it for regulatory compliance, consumer trust or balance sheet protection. With this in mind, there is a pressing need for the insurance industry to design affordable, data-driven insurance products that enable Mobility as a service (MaaS) providers to offer the necessary cover to their clients. In order to facilitate this process, insurers need a good understanding of new mobility business models, remembering that all new mobility segments represent risks that a large proportion of primary insurers would classify as non-core or edge-of-appetite for a number of reasons. These are the fluid nature of user behaviour, high vehicle utilisation, increased passenger exposure, unproven claims history, untested technology, and how the new models fit into existing infrastructure and social acceptance.

Challenges: Need for bespoke coverages

From car sharing and rental to subscription or ride-hailing, MaaS is creating new needs with insightful data sets which requires new insurance and risk solutions.

Our offering

MaaS platforms require unique products and services from insurers. We help our clients design flexible products that meet the needs of the market and mitigate risk through the use of increased data availability.

Learn more about how we can work with you on MaaS insurance solutions:

Technology-enabled fleet insurance

Insurers typically struggle to turn a profit on commercial auto. Their challenge is to price risks appropriately and limit balance sheet exposure. With this in mind, insurers need a way to help clients reduce risk exposure and lower costs. Leveraging data analytics and after-market safety technology to help reduce losses offers insurers the opportunity to create new data-driven commercial auto insurance products and services.

Our experience at Munich Re shows that, whilst getting the basics right in terms of risk selection, pricing and risk management remains fundamental. And using risk-mitigating technology helps elevate the traditional components of underwriting to new levels. By adopting a more data-driven approach and combining this with a redesign of the value proposition, insurers are not only able to carve out profitable market segments, but can also shift their motor fleet insurance offering away from a pure commodity purchase to a product that becomes integral to a client business.

Challenges: Implications for profitability

Commercial motor insurance is a growing market segment and a crucial line of business for many insurers. However, unprofitable combined ratios are commonplace.

How does it correlate with technology-enabled fleets?

Our offering

Vehicle technology can not only help make roads safer, but also improve profitability. We provide a modular consulting approach to our clients, primarily focusing on strategic guidance, underwriting and technology-based value proposition design.

Learn more about how we can work with you on technology-enabled fleet insurance solutions:

Autonomous vehicles

Globally, over 1.24 million people are killed each year as a result of collisions involving vehicles, not to mention the vast number of individuals and families affected by life-changing injuries suffered in road accidents. Our research indicates that around 80% of these accidents could be avoided with the predicted increase in automation. While there is no doubt that the potential societal benefits are immense, there are significant challenges for many industries as the road to automation develops, and the insurance industry is no different. Even though the decrease in accidents will undoubtedly reduce the need for motor third-party liability covers, or at least lead to a reduction in premiums, insurers also need to consider a potential shift in dependency from retail to commercial risks.

In particular, as autonomous vehicle technology becomes more widespread it is likely to result in a shift in consumer behaviour towards mobility consumption rather than car ownership. As a result, we may see a shift from retail to commercial dependence. Insurers with retail-dominated portfolios may need to review their business models in order to remain relevant in the future.

Advanced driver assistance systems

The implementation of advanced driver assistance systems (ADAS) and autonomous vehicle technology has significantly affected how we view risk, the result of which will be gradual replacement of traditional motor insurance with technology-based motor insurance. Within this new segment, the ability to capture, store, and analyse behavioural data, mobility patterns and vehicle data will be integral to how we underwrite and price mobility insurance. Solutions need to factor in all relevant new technologies, such as autonomous breaking or lane departure systems, and to consider their influence on the frequency and severity of vehicle accidents.

Challenges: Impact on product, pricing and distribution

The concept of the vehicle as the insured asset is changing radically through increased safety technology and connectivity. Insurance solutions need to factor in how this impacts product, pricing and distribution.

Our offering

We co-create approach to jointly develop unique products and sophisticated pricing techniques for evolving vehicle technology.

Learn more about how we can work with you on insuring autonomous vehicles and ADAS:

Electric vehicles

The distribution and registration of electric vehicles worldwide hits new records every year. For example, over 10 million electric vehicles (battery electric vehicles and plug-in hybrid electric vehicles) were sold globally as at the end of 2020, an increase of almost 3 million over the previous year.

A number of factors are stimulating demand for e-mobility. These include government incentive schemes, expanding new vehicle charging ecosystems, decreasing manufacturing costs of high-voltage batteries, EV’s drawing closer to internal combustion engine vehicles in terms of cost, and a growing number of EV models being produced by OEM’s (see diagram below). These trends will only accelerate, making refinement of EV risk assessment all the more urgent. Rising EV sales are both an opportunity and a hard-to-quantify risk for motor insurers. The fact that it is a relatively new market means that there is currently insufficient data available to properly price EV solutions. It is not yet known whether electric vehicles pose a higher, lower or similar risk when compared to internal combustion engine vehicles.

Challenges: Assessment of the risks related to EV

Electric vehicles (EV) risk assessment and pricing is currently based on very limited data.

The main topic mobility insurers need to address is: Do EV’s pose a higher, lower or comparable risk, relative to internal combustion engine vehicles?

Our offering

We offer EV product consulting to set up dedicated EV coverages, and EV ratemaking by creating a full range of risk segmented features, tailored to the clients portfolio.

There are currently 4 main divers for global e-mobility

The focus is on governments, charging, battery costs and OEMs

Learn more about how we can work with you on EV solutions:

Would you like to know more?

Get in touch with our experts right away.

This may interest you

Contact our expert

.jpg/_jcr_content/renditions/cropped.16_to_9.jpg./cropped.16_to_9.jpg)