Thanks to the MIRA Digital Suite, Swiss Life scores with faster processes and more satisfied customers and brokers.

MIRA Digital Suite (MDS) pools Munich Re’s software solutions and services which help life insurers to digitalise their processes along the value-chain. Swiss Life Germany, specialising in biometrics and retirement provision products, is also very resolutely pursuing the path of digitalisation, and has been a pilot client and development partner of Munich Re for various MDS tools for many years.

Swiss Life Germany is one of the country’s fastest-growing life insurers. The company, which is part of the Swiss Life Group, has been demonstrating positive, above-average business results and increasing employee numbers for years. One reason for these successes is the rigorous digitalisation of its business processes.

“The aim of our digitalisation strategy is to establish communication channels with our agents and customers that are as short, integrative and rapid as possible. This facilitates our collaboration with them and provides us with decisive competitive advantages”, said Daniel Budde Head of Service Center for Private Customers at Swiss Life Germany since 2019. Previously, Budde was responsible for the company’s underwriting for five years. During this time, the number of underwriters on the team has more than doubled, and Munich Re has developed digital services such as CLARA and MIRApply Physician. This is no coincidence.

MDS users and development partners from the outset

On the contrary: Although MDS tools such as MIRA PoS and MIRApply Physician have speeded up processes and have helped qualified specialists with routine underwriting tasks, the underwriting effort at Swiss Life has continued to increase over the years. The reason for this is the insurer’s dynamic and sustainable business growth. To cope with this growth and maintain its high processing quality, Swiss Life Germany pressed ahead early on with the digitalisation of the application process using the MDS. As a pilot client and Munich Re development partner, the insurer was involved from the outset with virtually all MDS tools with the only exception beingMIRA PoS.

Organisational reasons were responsible for the fact that Swiss Life did not deploy the software-as-a-service solution for point of sale (PoS). “We do not have our own sales force. Instead, we take benchmark figures into account and sell our products through independent brokers and agents”, said Budde, adding that “this is why we use vers.diagnose and not MIRA PoS as our automated processing interface for new business.” The first risk assessment and comparison platform on the market, which is popular with agents, has been available since 2013 and is operated by Franke & Bornberg in collaboration with Munich Re.

You would also like to benefit from a digitalized underwriting and claims solution?

We will be happy to advise you!

The goal is wide-ranging straight-through-processing

"With its MIRA Digital Suite, Munich Re is the central strategic partner for us on our journey towards straight-through-processing of application and claims data in life insurance."

Stefan Holzer

Swiss Life Germany

Head of Insurance Production

MIRApply Physician – established and indispensable at Swiss Life

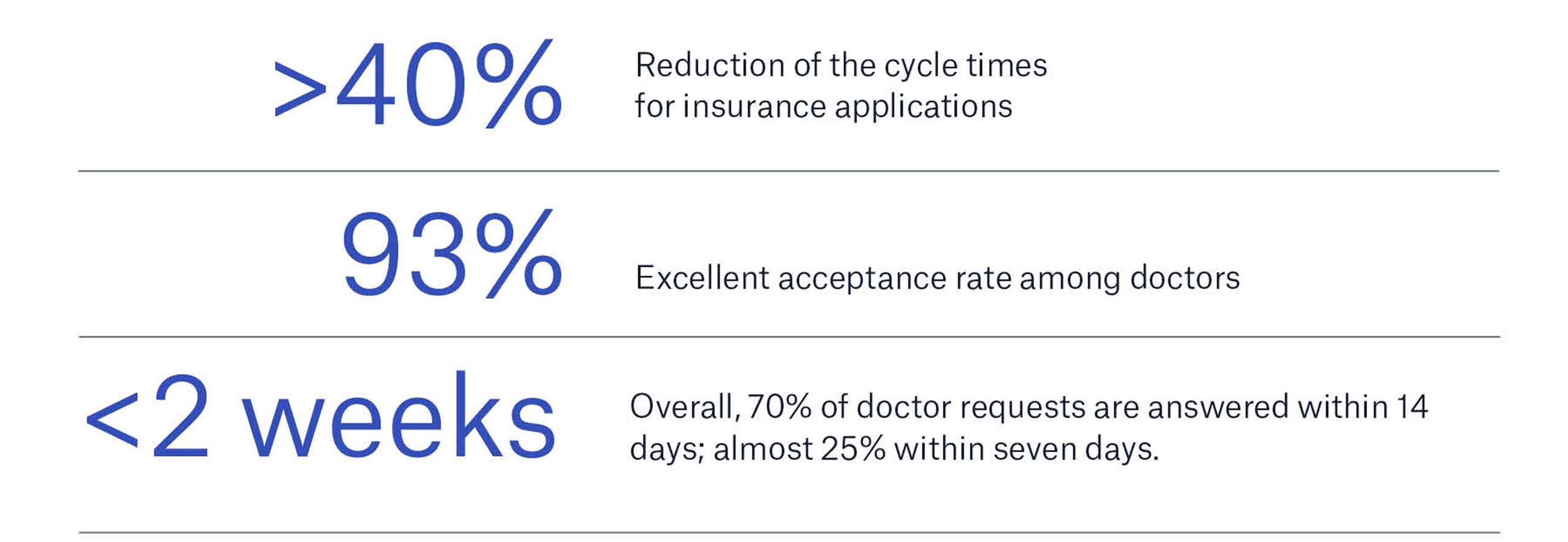

MIRApply Physician is Munich Re’s solution for electronic doctor requests. With this MDS service, Swiss Life Germany has reduced by more than 40% the cycle times of insurance applications for which risk assessment requires a general practitioner (GP) report. Compared to the previous situation -doctor requests in classic paper form prolonged the process of assessing applications by at least 30 to 60 days.

In addition, underwriting involved more work because the quality of the answers was often inadequate. Whilst GPs were able to certify illness, they did not come to any kind of conclusion about the status or severity of the illness. This prompted follow-up queries and caused further delays. “So we were won over from the very outset by the potential of the MIRApply Physician concept and got involved early on as a pilot client in the tool development process”, Budde recalled.

Initially, the greatest obstacle was the lack of acceptance by the medical fraternity. Over half of the health professionals deemed MIRApply Physician to be too complex in terms of content and too insecure regarding data protection, or rejected its use simply on the basis of what they had grown accustomed to. But since then the picture has changed radically. The acceptance rate in December 2021 was an excellent 93%.

What’s more: “For more than 25% of all doctor requests via MIRApply Physician, we received the response in fewer than seven days. For 70%, within two weeks’ time”, Budde reported. There are virtually no more follow-up queries. The doctor information collected digitally can be used almost in its entirety for risk assessment.

MIRApply Insured: From doctor request equivalent to end-customer communication platform

Spurred by the success of MIRApply Physician, Munich Re began setting up a comparable online tool for applicants: MIRApply Insured. Swiss Life is currently one of two pilot clients for this new digital service. “Initially, we used it very specifically for medical queries and, if necessary, sent a text message to applicants, requesting them to open the tool online and answer the additional questions. But this did not work, as the applicants lacked trust”, Budde continued.

Swiss Life therefore changed its communication method and its use of MIRApply Insured. Today, Swiss Life sends letters again instead of text messages. In these letters, they explain to recipients all they need to know about MIRApply Insured and provide them with their very own access link. This scenario demonstrates that digital communication is not an end in itself. It is more about end-to-end and hybrid integration. This includes digital as well as analogue communication channels, depending on the customer’s expectations – another key finding from the pilot phase. This too is new: at the suggestion of Swiss Life, additional medical information is no longer collected online. Instead, all open issues relevant for risk assessment are resolved.

“This is in line with our philosophy”, Budde emphasised: “We are no longer continually asking follow-up questions and, if possible, we try to clarify all issues at once.” Swiss Life and Munich Re, as part of their excellent, and constructive collaboration, have thus further developed MIRApply Insured into a comprehensive communication platform for digital interaction with applicants. More than 160 applicants have already benefited from this in the ongoing pilot phase.

At Swiss Life, CLARA is synonymous with client proximity and is a key selling point

The MIRA Digital Suite is not restricted to the sub-processes of risk assessment. The Claims Risk Assessor CLARA is the tool in Munich Re’s portfolio that is used for digital claims handling. What are the strengths of this tool? As a data-driven automation solution, CLARA reduces the average processing time in claims handling by as much as 50%.

This is possible thanks to the use of structured telephone interviews that have evolved into a key selling point for Swiss Life's marketing. “The use of CLARA here is not driven purely by efficiency, even though accelerated claims handling benefits everyone involved. From our perspective, the personal access we obtain through CLARA, and the associated emotional benefit the customer receives, are more important”, Budde said.

"The use of CLARA here is not driven purely by efficiency, even though accelerated claims handling benefits everyone involved. From our perspective, the personal access we obtain through CLARA, and the associated emotional benefit the customer receives, are more important.!"

Daniel Budde

Swiss Life Germany

Head of Service Center Private Customers

Previously, customers applying for benefits were sent a questionnaire comprising more than 20 pages. But many of the queries had no relevance at all for the cases in hand. This entailed unnecessary work for customers – who always felt somewhat insecure about filling in the forms and making mistakes in the process. Also, insurers normally require many additional documents from customers applying for benefits. Customers are often unsure which documents they need to submit and in which form, and how to obtain them, so documents are often missing. This leads to follow-up questions on the part of the insurer and delays in claims handling.

“Now, when we conduct a CLARA interview, we explain to the customer in a one-on-one meeting which documents we require for the decision-making process, in which form they need to submit and who issues the documents”, said Budde. This speeds up the process, and customers experience Swiss Life as a partner who cares and is interested in their needs. “This has long been a key argument in sales talks”, Budde confirmed.

Nowadays, in the event of a claim, customers actively ask for a CLARA interview. Swiss Life uses the tool in 40% of all cases. An interview is conducted within 48 hours of a claim's receipt. After that, everything goes very quickly: as many as 10% of all of Swiss Life’s applications for benefits are decided on the basis of CLARA interviews. “Our record is less than a week for all the steps: from receipt of the customer’s claim for benefits to conducting the CLARA interview to granting the benefit to the customer”, Budde explained.

The next phase: Swiss Life is testing CLARA plus

Can this record ever be beaten? This cannot be ruled out since Swiss Life Germany and Munich Re are continuously working on further process optimisations. A relevant example of this is Swiss Life’s involvement as a pilot client for the latest tool in the MDS toolkit: CLARA plus. Thanks to detailed information on around 400 occupational profiles and their associated activities, CLARA plus is able to calculate the degree of disability for 80% of all applicants for disability benefits and to arrive at a conclusive decision.

As a pilot client , Swiss Life is testing whether CLARA plus really meets the demands of this value proposition. “We had originally fed the tool with data from historical cases. Then we compared the disability decisions that were determined automatically with the decisions taken by our claims handlers in the historical cases”, Budde explained. The result: the quality of the disability decisions delivered by CLARA plus and as a result of classic claims handling is equivalent.

For Swiss Life Germany, the commercial viability of the MDS tool is thus proven. The company has been testing CLARA plus in a live environment since the end of 2021. Since then, the degree of disability has been calculated automatically in more than 120 cases. This figure does not sound particularly impressive, but it actually represents considerable time and cost savings. “At the moment, we only use CLARA plus for particularly complex cases – such as mental disorders”, said Budde. Even experienced claims handlers often have to rely on time-consuming and costly medical reports in order to be able to assess these cases. Thanks to the CLARA plus algorithm, which is based on structured requests and comprehensive medical and occupational information, a substantiated decision can be arrived at even in such complex cases, and expert opinions are no longer required in every case. Swiss Life thus saves itself various expert opinions, each of which costs not only time and human resources, but usually also several thousand euros.

Analytics and outlook: There is always room for improvement

The CLARA plus algorithm is constantly improving as the amount of data increases. The same also applies for the other MDS tools. In addition, the MIRA Digital Suite provides users with an analytics function with which they can analyse their own case data and derive valuable new findings. “We use the analytics capabilities of MDS to be able to respond in real time to trends and to enhance our processes and portfolio in a targeted manner”, Budde confirmed.

The goal is end-to-end digitalisation of the processes along the value chain. “Together with Munich Re, we have already reached many milestones. But nevertheless, just like life insurance overall, we have yet to realise end-to-end straight-through-processing”, said Budde. The tools in the MIRA Digital Suite are the main prerequisites for this. Once the components of the MIRA Digital Suite have been integrated fully into the processes, and the exchange of data between the tools is automated, nothing will stand in the way of digitalised claims assessment and handling.

Downloads

Our experts

/Wolfgang-Demmerich.jpg/_jcr_content/renditions/original.image_file.120.120.file/Wolfgang-Demmerich.jpg)

Related Topics

properties.trackTitle

properties.trackSubtitle