properties.trackTitle

properties.trackSubtitle

Air cleaner than in an operating theatre

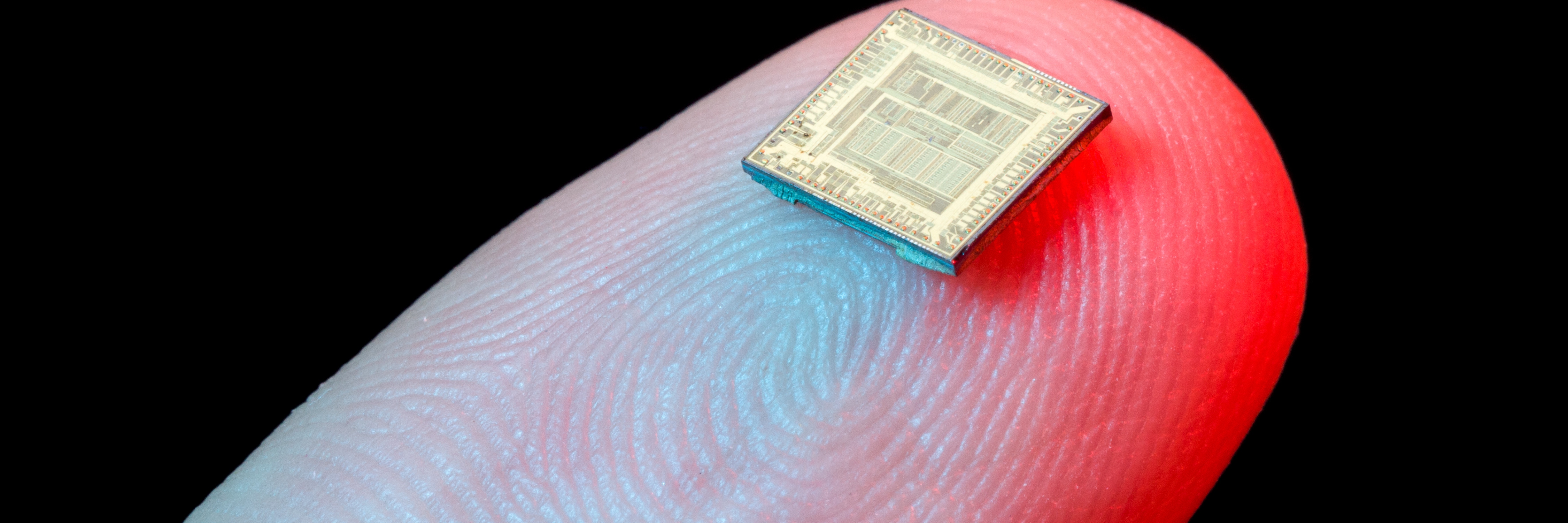

Even though only small areas of the clean rooms were directly affected by the fire, smoke and soot damaged extensive areas of the manufacturing systems and production area. The highly technical production process for manufacturing these chips comprises numerous steps where special machines are used (see diagram on next page). Since even the slightest impurity can affect the production yield and reliability of the chips, the air is kept virtually dust-free.

The two clean rooms contained a total of more than 1,400 special machines and appliances, many of which were destroyed by the fire or damaged by smoke, soot and the resulting corrosion. There was also the risk that the abrupt power cut that followed the explosion could have damaged the sensitive electronics in the devices. For this reason, even machines and equipment that displayed no outward signs of damage had to be checked for error-free functionality within extremely narrow tolerances. An additional concern was that – aside from the direct consequences of the fire – the large number of expensive wafers that had remained in the production process might be lost because of uncontrolled exposure time to chemical substances (see diagram below). Despite the localised impact of the fire, property damage to equipment and buildings and the costs for the business interruption in the semiconductor factory amounted to US$ 860m.

Support from external experts

In view of the complex production process, it quickly became apparent that valuing the loss and exercising any loss-minimisation options could only be achieved by bringing in external specialists. It needed to be established which machines and equipment could be cleaned or repaired, and which needed to be replaced with new purchases. Special expertise was required in this area on account of the precision machinery and the extremely low error-rate tolerances for the final product. The views of insurers and policyholders often differ significantly with regard to such assessments. A further aspect was that help from the external specialists would make it easier to estimate when production could be ramped up again to achieve the normal level.

Whether processor or memory chip, all manufacturers produce their semiconductors using the same basic technology: photolithography.

How a chip is produced

The starting point (1) is the cylindrical, single crystal made of pure silicon. This single crystal ingot is cut into thin slices (wafers) using ID saws or wire saws and then polished smooth in several steps. Oxidation on the surface takes place at high temperatures, during which a thin layer of insulating silicon dioxide is formed (3). In the next step, the wafer is coated with a photoresist layer and a template attached with the pattern of the circuits that are to be transferred to the wafer (4). The photoresist changes as a result of exposure to light and can be removed with the help of a solvent. In this way, silicon oxide surfaces are obtained with the structure of the circuits. There are subsequent steps such as doping, stripping and etching to permanently transfer the circuit structures to the wafer (5). The unexposed photoresist is then removed and the individual chips are finally sliced from the wafer.

Whenever chip production is started, a certain period of time is required before it has warmed up to the point where the yield of error-free chips has reached an acceptable level. This ramp-up process can take up to two months and, under certain circumstances, extend the phase covered under a business interruption policy.

Because there are only a small number of memory chip manufacturers worldwide, the production stoppage affecting this one producer had massive ramifications around the world. Immediately after the loss became known, the price of memory chips rose sharply in line with the reduced supply, as the facilities affected by the fire were responsible for a substantial portion of global memory chip production. In addition, OEMs (original equipment manufacturers) who had concluded long-term contracts to purchase the memory chips from the manufacturer concerned had to fall back on other means of supply at very short notice. Not only was this difficult to do, since every OEM affected immediately began looking for alternatives, but it also involved high costs on account of the increased prices for memory chips.

Bottleneck threatens Christmas business

Unprepared for a breakdown in supply

Because the console segment was not part of the group’s core business, not enough attention was paid to the risks emanating from globally networked supply chains. For example, the company had omitted to split procurement of critical components like the memory chips between at least two suppliers in order to reduce or eliminate any potential bottlenecks. Particularly in the case of memory chips, which as bulk products feature no special specifications, it is very easy to fall back on different suppliers. Ultimately, the loss from the contingent business interruption came to almost US$ 500m, although the insurers had to pay a much smaller amount thanks to the agreed sublimit of US$ 150m and the policyholder’s deductible of US$ 25m.

A further problem arose at a different OEM, which had also concluded a long-term supply agreement with the semiconductor manufacturer concerned. This OEM was still not being supplied with chips by the manufacturer even as late as the following January, despite production being up and running again by this point. One could speculate that the chip manufacturer had seized the opportunity and preferred to sell its chip components on the spot market at a higher price, rather than sticking to the long-term supplier agreement (at lower prices). The ultimate losers were the insurers, who had to refund the price difference to the OEM under the CBI cover. They would only have been freed from the obligation to indemnify if there had been a break in the causal chain that led to the financial loss. However, there was no evidence for this.

Lessons to be learned from the loss

Using sublimits to reduce exposure

For underwriting, the challenge is to identify critical weak points and to make allowance for these in the contract design. The problem here is that underwriters depend on the information provided to them. They can never hope to know more than the customers themselves, and it would be an illusion to believe they could identify all the different cogs and wheels that intermesh in complex production processes. For this reason, CBI losses can never be completely ruled out given today’s international division of labour. The location, date and extent of CBI losses cannot be controlled, something they share in common with natural catastrophe risks.

In such a case, sublimits are the most effective way of limiting exposure. In this context, it is sensible to distinguish between named suppliers and second-tier unnamed suppliers. The named suppliers are expressly listed in the policy. Since it can be assumed that named suppliers apply higher standards to avoid production breakdowns, higher sublimits can be agreed for them than for unnamed suppliers. Furthermore, for risks involving complex supply chains, the underwriter should form a clear picture of the quality of continuity management.

Do not needlessly relinquish recourse claims

Following a loss, the topic of recourse should be examined since, in the area of CBI, it is usually third parties (in this instance the subcontractor responsible for the gas connection) who trigger the loss. However, policyholders often agree to waive recourse action under the policy against their named suppliers because they do not want to put a strain on future business relations, and because the insurer will pay for the loss anyway. In this situation, the insurer has no means of taking action against the party responsible for the damage without the consent of the policyholder. Insurers should therefore take care not to needlessly surrender their rights to recourse claims. When assessing the loss, insurers should also make a realistic assessment of their expertise and options, as was done so successfully in this case. External expertise was expensive but worth every penny. After all, it made it possible to significantly reduce the loss amount and also shorten the overall settlement process.

Last but not least, underwriters should consider what options the policyholder has in terms of alternative production sites. For example, the Asian semiconductor manufacturer operated facilities in other countries that also produced memory chips. Ideally, the extent to which a breakdown in one factory could be made up for by other production sites should have been specified when drafting the policy conditions.

Related Topics

properties.trackTitle

properties.trackSubtitle