Underwriting analytics

Unlock your underwriting potential with ALLFINANZ Insight

properties.trackTitle

properties.trackSubtitle

ALLFINANZ Insight distils complex data into consumable and actionable intelligence for key stakeholders; thereby putting you in control of your business, with timely, relevant, and actionable information.

Over 60 out-of-the-box dashboards provide users of Insight with additional prescriptive analytics and trends data to enable continual refinement of rules and processes, to optimise rules engine performance.

With a visually rich interface, interactive and dynamic dashboards provide understandable analysis of underwriting data enabling you to move beyond static charts.

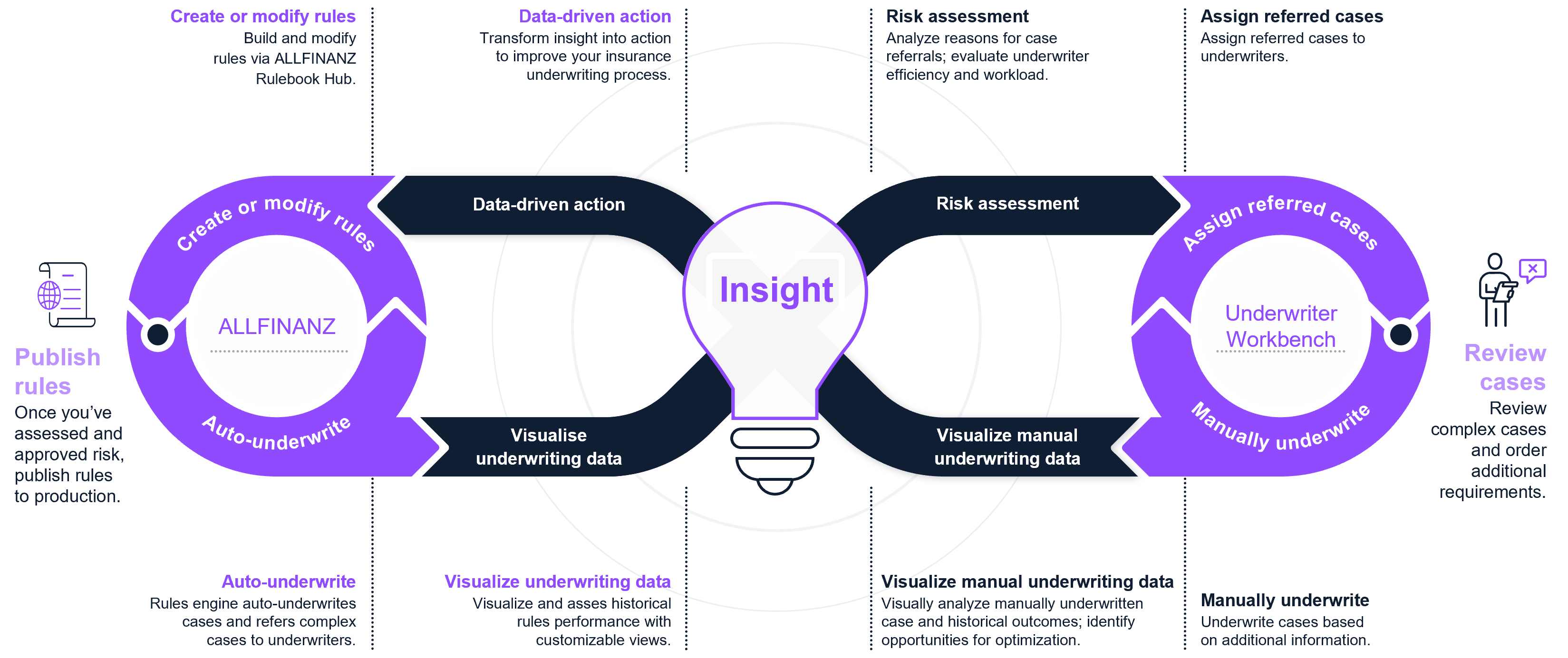

How does ALLFINANZ Insight work?

The benefits of underwriting analytics

Improve your STP rates

Visualize your underwriting systems working together

Monitor your costs and risk performance

Manage manual and automated underwriting performance

Analyze historical outcomes

Enhance your customer experience

Analyze, visualize and optimize your business

With Insight, you can analyze automation process and underwriting performance including underwriter workloads, average underwriting duration and trends, rules impacting referrals and more. Insight delivers advanced analytics by providing proactive recommendations for business use cases such as ‘How can we increase our STP’? and more importantly, ‘By how much’?

Partner with us to enable the future of insurance technology

Best-in-class advanced analytics

Future-proof your business

Improve your business performance

Leverage Munich Re's industry expertise

Let's Talk